FinTech continues to expand, with the majority of the market’s growth coming from B2B FinTech sales. Although this growing industry has opened up many opportunities for FinTech companies, it’s proving to be challenging to sell FinTech without a fat marketing budget.

Though the main selling point of FinTech products is to simplify and streamline finance, FinTech products themselves may appear complex and opaque to the banks and financial firms using conventional ways to perform their daily work. This becomes a challenge for FinTech companies during the sales process.

B2B FinTech firms also face a number of serious marketing challenges for new customer acquisition. Identifying the right prospect, reaching them, and turning them into customers can be very difficult for most FinTech companies, especially startups, since:

- Limited marketing budgets often mean fewer marketing options.

- Many B2B FinTech firms lack brand recognition.

- Many B2B FinTech firms struggle to convince buyers to adopt an unfamiliar product.

The good news: Any B2B FinTech company can create opportunities from these customer acquisition challenges. How? Let’s explore the things to follow whether you are selling to banks or selling to financial institutions.

What is Fintech Sales

Fintech sales refers to the process of selling financial technology products or services to businesses or consumers. This can include things like online banking platforms, mobile payment apps, and other technologies that are used to facilitate financial transactions and manage financial data. Fintech sales professionals are responsible for identifying potential customers, understanding their needs and challenges, and presenting solutions that meet their requirements. They may also be involved in negotiating and closing deals, as well as building and maintaining relationships with clients.

Here are 7 Affordable Yet Effective Ways to Boost B2B FinTech Sales

1. Identify Business Problems Early

Many FinTech companies make the mistake of approaching banks or financial firms with technical proposals that do not focus on specific business pain points and benefits.

What pain area can you resolve? Will your product help your customers drive revenue? You need to identify the industry challenges and their negative impact on your prospects’ productivity or bottom line.

Offering a product or solution that streamlines processes will not necessarily convince buyers to make a purchase. If you can identify the pain area, you might be surprised to learn that your product or solution could solve a different problem than the one you originally designed it to solve.

2. Choose The Right Person

There’s often a risk involved in anything related to the financial domain. Cold calling or approaching a random person with your product will not help you to identify the decision-maker or the visionaries within those organizations who have the tech-savvy, hustle, and motivation to drive AI adoption. Thus, you need to find the best affordable way to reach the decision-maker.

For large companies, the buying group can include:

- C-level executives, EVPs, and VPs interested in the financial, operational, and marketing aspects of a purchase

- Directors and department heads in charge of horizontal and vertical business streams

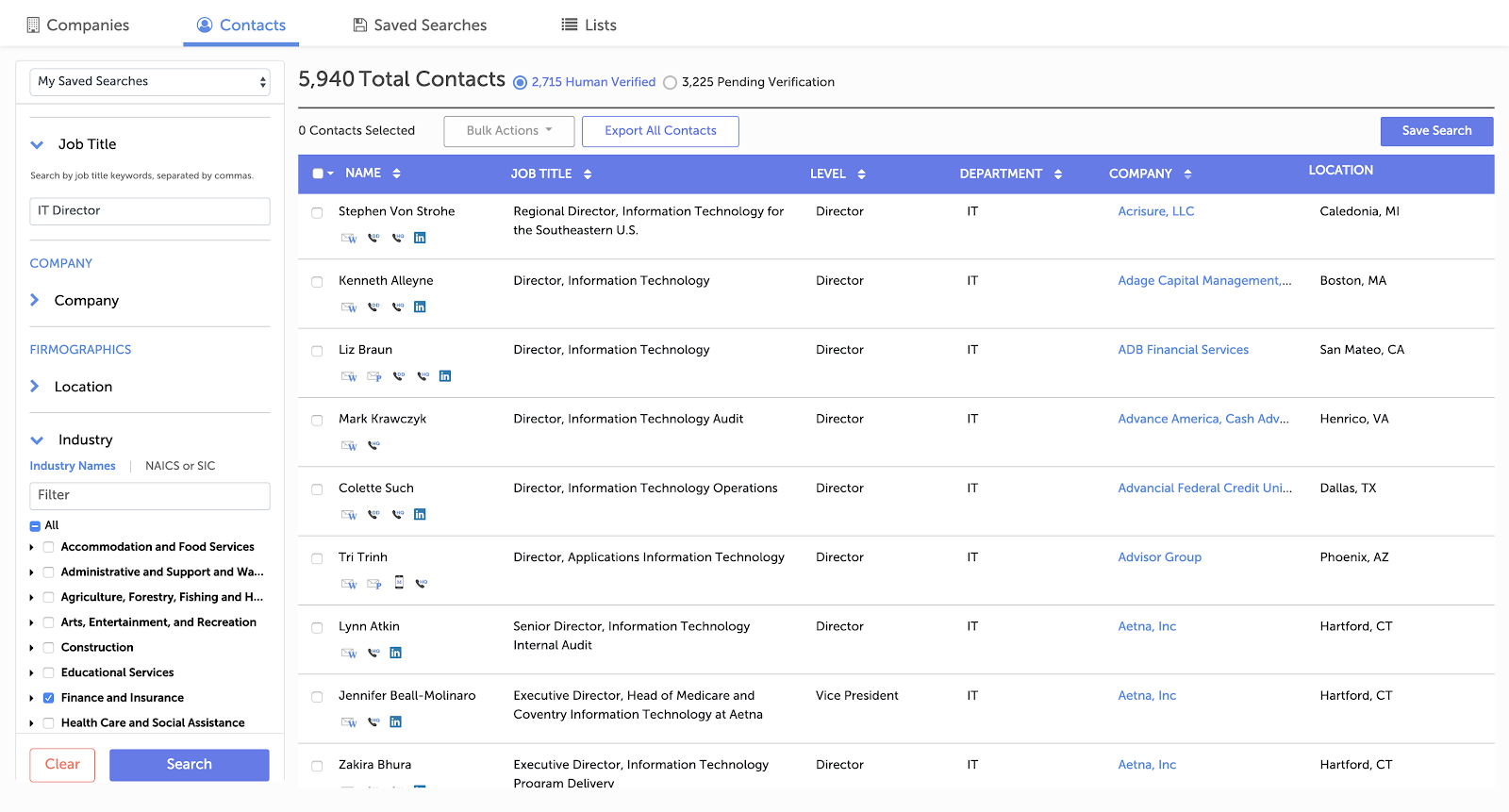

SalesIntel provides you access to a 95% human-verified banking and finance industry database with millions of direct-dials of the decision-makers. Our B2B data helps you save time on prospecting and spend more time selling.

Read About – Zoominfo Similar Sites

3. Say No to FinTech Tourism

While selling to the banks is about breaking down the walls of conventional record-keeping techniques to create a climate of innovation, you don’t need to give away hundreds of hours of consulting to make the sale.

People working in banks or financial institutions value time. Therefore, it is important to strike the balance between just tourism (bombarding prospects with too much unnecessary information) and tourism with intent (keeping it crisp and specific to their need).

The best way to go about it is to show them the demo and/or let them use the product for a few days before asking them to make a decision.

4. Be a Specialist, Not a Generalist

Don’t attempt to solve everything. Banks and financial firms believe in competition and like to be treated special. High-precision industries like banking have an extremely low appetite for failure and favor specialists over generalists. They are less likely to entertain you if you take a generalized approach.

SalesIntel lets you study the technographic and firmographic data of your prospects so that you can approach them like a specialist by including the information in your sales pitch to keep the communication engaging and interesting for your prospects.

5. Learn To Please Everyone

Sometimes selling to the banks is a cross-department, cross-discipline affair. You need to make sure that the influencers (end-users) are convinced about the need for your FinTech product or solution.

Partnering with a bank or a financial institution will definitely involve security concerns, as well as data and Information concerns. Depending on your scope, you also need to win over VPs, Directors, and C-Suite executives by explaining them in terms of innovation, marketing, competitive edge, improving customer experience, and loyalty as well.

6. Start Small and Expand Your Footprint Over Time

There might be a rare situation where winning deals with banks and financial institutions becomes easier. A much better approach to get your foot in the door is to try to implement a small project and expand from there. This will create a win-win situation for both you and your customers as it will involve less risk compared to implementing a big project.

Implementing a small project will also allow you to focus on offering better customer service to build trust and cross-sell later. Once you build up your trust, knowledge about their processes, and capabilities of your product, your clients will be prepared to deploy your solution on bigger projects in the future.

7. Utilize the Power of Email Marketing

When it comes to B2B sales lead generation and nurturing, one cannot underestimate the power of emails. In fact, 73% of B2B marketers rate email campaigns as either “excellent” or “good” as a part of their marketing strategy.

Email marketing allows you to focus on building relationships with those you have qualified based on your lead qualification criteria.

However, you need to make sure that your email offers and personalized messages reach the right person. Partnering with a reliable B2B data provider who can help you with accurate banking and finance industry database will help you tap the decision-makers and save time.

B2B FinTech Sales Can Be Successful, If…

Banks and financial institutions often have a complicated organizational structure. Sometimes it seems like you’ll never break through to the right people.

Even if you do, you may struggle to convince them if you don’t have enough information about them. Moreover, you need to reach them before you lose them to your competitors.

Thus, you need to have the right person’s contact and company information in one place to simplify your approach and reach them before your competition breaks the ice.

SalesIntel works as a one-stop solution where you can access a large chunk of industry-specific human-verified data along with their firmographic and technographic data on one platform.

Want to know how it will work wonders for you? Schedule a FREE SalesIntel Demo!