Few enterprises have deeper pockets than banks – and yet they are largely considered one of the toughest clients to make.

Obviously, it is not for lack of money. Banks are used to writing checks all the time, and major institutions like Goldman Sachs, Wells Fargo, and Bank of America possess among the largest financial resources on the planet. But banks are notoriously dollars and sense focused.

Moreover, when it comes to buying technology, they prioritize two things above all else: security and reputation. Banks work under strict compliance and tend to have a much more rigid organizational structure. They would rather lose money through inefficiencies than adopt a new cutting-edge solution that comes with even a whiff of risk. That’s why selling technology to banks is tough. You can’t just lure them with low costs or cool new features.

That said, banks are now desperately looking for new technologies to support and upgrade their crumbling legacy systems. If you don’t already know, many banks struggle with outdated infrastructures built from decades-old technologies that create bottlenecks in their expansion and evolution. Banks in the US alone have earmarked around $67 billion for tech purchases in 2019.

In other words, at a high level, banks meet the two most crucial elements of a lucrative client:

- They are actively looking for new solutions.

- They have more than enough money to pay for it.

The challenge for technology companies is navigating through the complex and rigorous buying process to ensure you always come out on top. Here is how you do it:

Pitch Your Company

Bank purchases typically start with an RFI (Request For Information) and include competitive bidding. That means you’ll be probably competing with tech giants like Oracle or IBM, and given how risk-averse bankers are, your first task is to establish your credibility. Focus on selling the reliability of your company, first and foremost. Small firms or startups may have a tough time crossing this barrier, but it is a surefire way to get some established banking consultants on your team who can lobby or lend credibility for your enterprise.

Find the Right People

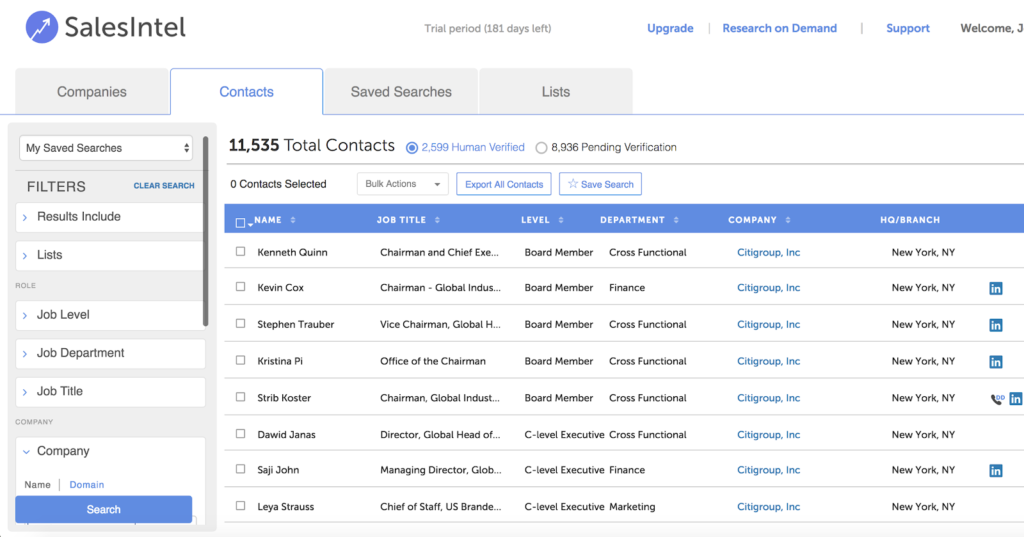

Once you have a foot in the door, it’s time to navigate the buying center. As mentioned earlier, banks have a rigid organizational structure, and thus, it is critical that you have the right pitch for the right people. There are generally 4 kinds of people you’ll find in any banking organization:

The Power: They are the ones who make the decision

The Money: They are the ones who pay for the purchase

The Influencer: They are the ones who will navigate you around the system

The Blocker: They don’t like your product or are an influencer for any other vendor

You’ll need first to recognize and then simultaneously get in touch with all these people to create recognition and value for your product. There are times when a bank doesn’t even know they need a particular solution until it is pitched to them. So prospecting them even before they put out an RFI can give you an early start.

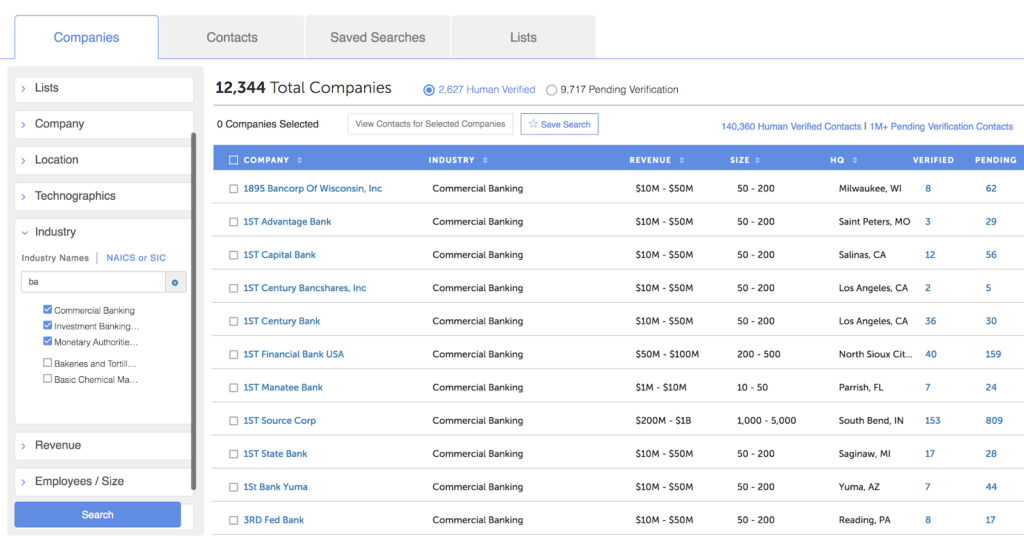

Acquiring all this information requires in-depth research and diligence. An easier solution would be to purchase a sales contact database and get straight to the selling part.

On a related note, SalesIntel offers comprehensive contact data and buying intelligence on the banking and finance industry to make your task easier.

Customized and Relevant Content

Bankers are many things, but they are not fools. They have the money, but they aren’t going to just throw it away. You need to explain the precise value you deliver, and you must reach out to each person with relevant content. Explain ROI benefits to the CFO, technical details to product managers, efficiency to the operations head, and so forth. You need more than just a fancy presentation with a lot of buzzwords. You need to send contextually relevant information to the buying center.

Have Patience

A typical bank purchase can take anywhere between 9 to 18 months to finalize and almost another year for deployment. For many companies (particularly startups), this can not only be frustrating but a matter of survival. Stay put and keep revising your content as the time progresses. There may also be cases where one or more people you have already convinced leave the job or have their title changed, and thus you may need to start the process all over again.

Closing Remarks

As tough as they are to sign up, banks are also one of the most loyal customers around. So once you have signed up a bank, you can rest assured that it is going to be a long-term partnership. All you need is to find the right people and have the right pitch. SalesIntel can get you the first, so you can figure out the latter. Let’s get started.