Summary

Do you know – 91% of companies debate lead quality every day?

One of the most important aspects of your CRM that require constant upkeep is your deal pipeline. The more control and visibility you have of your sales pipeline, the more revenue you’ll bring in.

HubSpot Research found a positive relationship between the number of opportunities in your pipeline per month and revenue achievement. The more opportunities in your pipeline, the more likely you are to reach or exceed your revenue goals.

Salespeople can only be effective if they have the right decision-makers and the right influencers for outreach.

In our webinar transcript below, we share advice from two experienced, SaaS CEOs on how you can put data and intelligence into the sales motion to give them efficiency, generate a consistent sales pipeline, and make the go-to-market team efficient. Learn where you should focus on your limited sales and marketing budgets, especially at times like this when we are all asked to do more with less.

If you’re a mid-size company or recently funded and expected to grow or become more efficient in your go-to-market efforts in 2023, enjoy the session led by veteran leaders Manoj Ramnani CEO of SalesIntel, and Mike Burton, Co-Founder at Bombora. Mike focused on creating 5 paths his go-to-market teams use to get them aligned and confident in their work using firmographics, technographics, and buyer intent intelligence.

Here’s a quick summary of the 5 topics discussed in order:

- Quantifiable ICP & Lead Quality Definition

- Surfacing “In-Market” Accounts for Better ABM

- Brand, Content, & Paid Targeting Prioritization and Alignment

- Predictable Forecasting & Capacity Planning

- NRR Expansion

——————-

Introduction

Ariana: My name is Ariana Shannon. I am the marketing director here at SalesIntel, and also your MC for the day. With me, I have the CEO at SalesIntel, Manoj Ramnani, and also Mike Burton, co-founder of Bombora here today to talk about the 5 Steps to 5x Pipeline Efficiency. That way, you can get your CEOs on board with your go-to-market strategy. Please feel free to go into the Q&A, and ask all of the questions that you have. We will have a segment at the end of this for you to get your questions answered. Also, feel free to take screenshots and take notes. It is going to be recorded, but we want to make sure that you get all the information that you need from this today. All right, with that, Manoj, over to you, let’s take it away.

About SalesIntel

Manoj Ramnani: Thank you, Ariana. Welcome everybody. I’m looking forward to the discussion. Most legacy B2B pipelines have the following stages:

- Lead generated — (also known as lead assigned) is defined as a lead that met the basic criteria of a contact who had an interest in the product or service.

- Meeting scheduled — typically referred to as an introductory meeting where a salesperson would qualify the prospect and determine if they were worth pursuing. The ideal outcome of an introductory meeting is a product demo.

- Demo completed — an opportunity for the salesperson to show the product’s capabilities.

- Request for quote — typically indicated that the prospect was requesting pricing information to make a purchase potentially.

- Proposal sent — a proposal or price quote was configured, produced, and sent to the prospect for consideration.

- Negotiation — the process of coming to an agreement on the price for the offer.

- Closed-lost or closed-won — indicated the outcome of the deal.

Fast forward to 2020 and a good B2B sales pipeline is more than a simple process diagram and deal outline that tracks a deal status.

Mike, super excited to join you here. Quick intros. My name is Manoj Ramnani, founder and CEO at SalesIntel.

A quick plug about what we do. We help you generate the pipeline efficiently. How do we do that? For different pillars, we help you identify your ICP, who is your ideal customer profile. From there, with our partnership, Bombora, who you’ll hear shortly from Mike, we tell you who’s in the market from those ICP. Then we give you the actionable data that includes firmographics, company technographics, contact data for people, intent data, and more.

There goes our tagline, “Find your people, build your pipeline.” We help you build your pipeline by finding the right people and making sure that we have the human touch of quality across the board with the data. That’s about SalesIntel and me. Mike?

About Bombora

Mike Burton: Thanks, Manoj. Thanks to everybody for joining. Looking forward to today. I’m Mike Burton. I’m a co-founder of Bombora. We are an intent data company. Effectively, we listen to companies, companies that you want to sell to, or companies that maybe are already your customers. We listen to them consuming research across this cooperative of media properties and other constituents that we’ve built and maintain over time. Then we can surface for our customers when we see these companies showing abnormally large spikes in research behavior that are relevant to your business. The idea is to plug this information into your sales and enterprise marketing motions, which we’ll talk about today so that you can have more meetings and sell more of your products. Hopefully, a good starting point to kick us off.

2023 GTM Challenges

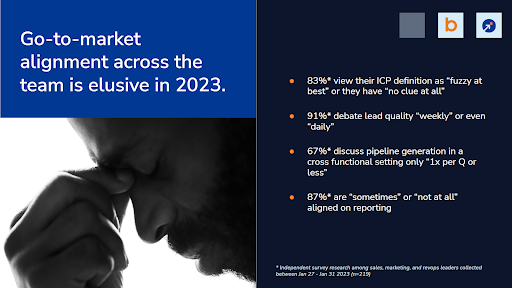

Manoj: Great. Thank you, Mike. You brought up putting data and intelligence into the sales motion to give them efficiency, to make the go-to-market team efficient. I want to set up the stage here and start this thing by sharing the survey results. Here are the survey results that we got from over 200 B2B companies and the sales and marketing revenue operations, the leaders. They have reported these numbers, and I was shocked to see some of the stats here. 83% of the companies view the ICP definition as fuzzy at the best. In many cases, they just don’t have a clue at all. 91% of the companies debate lead quality on an everyday basis. Think about it. A lead is coming in and you are having a debate about, “Is it a lead you should work on? Is it a good lead for us or not?”

67% discuss pipeline cross functionally just once a quarter or less. Cross function is your sales, your marketing, your revenue leaders, and your product leaders coming together to discuss the pipeline generation and 87% are sometimes or not at all aligned on what should they report on. This just frames and puts the very topic of inefficiencies in pipeline generation and inefficiencies in revenue organization, and that’s a result of misalignment. We are here in 2023 and these are just simple and fundamental things, the majority of the companies don’t have in place. How do we overcome that?

Mike: I think one of the things I’ve seen, especially in the top bullet, is that especially smaller companies, they literally don’t know yet. They’re not deep enough into the market, they’re not deep enough into their product evolution to have figured out exactly where they win. I think the trap that companies can fall into is, well, let’s not put any flag in the ground.

I think the key is, even though you’re not sure, still make a bet, still create an ICP, still take the information you have, and put a flag in the ground, even though you know that it can’t be perfect because you don’t have all the information yet. Just because you feel like you don’t have all the info, doesn’t mean you can’t make a definition and stick with it for a year or whatever it is.

5 Paths to 5X Your Pipeline

Define & Quantify Your ICP

Manoj: Yes, take the first step and then iterate on it. Great point, Mike. We came up with these five steps, these five nuggets that we want to share with all of you on 5 paths to 5xing your pipeline efficiency. I’m sure there are others, but here are some of the nuggets that we want to share with you.

All those five buckets are one, defined as Mike mentioned, even if you don’t know, if you’re starting out your business and you don’t know who your ICP is, just take a stab at identifying your ICP, quantify how big is that ICP and then iterate on this, we’ll talk more about it. That’s the first and the fifth bullet points here.

Second is, we’ll touch on might we dive deeper into identifying and surfacing those companies from your ICP that are currently in the market, where you should focus on your limited sales and marketing budgets, especially times like this when we are all asked to do more with less. Third is targeting the right people. Within the companies that are in the market, you want to be able to talk to your decision-makers and get the right outcome with the right messaging. At the end, we will talk about how we do predictable forecasting and planning. Those are the five things we’re going to touch upon.

Let me dive deeper into the first, defining your ICP and quantifying it. How do we do that? Before we go and define our ICP and quantify how big is the ICP, let’s take a step back and look at these three AMs, I say that, TAM, SAM, and SOM.

We are all familiar with TAM – Total Addressable Market. This is the market number that in my opinion, you should keep it for the founders to put it in the investor deck. This shows you how big is the market, who can possibly buy your solution.

Second is Service Available Market. What portion of market fits you today? Yes, you can go and sell your product and your services to a huge, huge, huge market, but today, what percent of that market, what portion of that market you can service based on the product that you have, based on the team that you have, based on the resources that you have.

Then finally off that Service Available Market, Service Obtainable Market, what percent of that market can you obtain today? What percent of the market can you reach today effectively through all your channels, whether it’s your marketing channels or your other outreach channels? Your ICP is at the very best SOM, if not a subset of that SOM.

With that, let’s share with you what we did. If you look at our business, we are in the revenue intelligence business. When you look at the TAM of our business, it’s huge. It’s infinite. The gardeners of the world, they have put 30 to 50 billion as the time for our business. If we say that, “Okay, we are going to go after the 30 to 50 billion,” that essentially means that every company that is selling to other businesses, every company that has a sales and marketing team, they become an ICP for us. Well, if I direct my team as a CEO to say, go after that with the limited resources that we have, do you think you’ll be successful? No, so what did we do? We saw that when we targeted our sales and enterprise marketing motions within our ICP, our win rate was three times in that ICP.

Let me just unpack for 2023, this is our real planning that we did in December, we paired the 30 to 50 billion market down to 900 million. This year, we can focus our energy, our efforts, our resources on this 900 million market, and that was, if you look at here, dominated based on where our product is today, who can be serviced. We figured out, you know what, yes, we have some international data but are we the best there, or should we play in the area where we are the strongest one?

We know we are number one when it comes to high-quality decision-makers in the US. We identified 20 verticals where we have higher win rates than the others, so that’s how we identified one part. The second part was, we looked at the data from the firmographic side to say, companies of what size are good for us? Like what size of companies can we serve with our product and our services the best? We identified companies with 50 to 500 employee size or if they have raised the money and they are accelerating their go-to-market motions.

Then finally, we put the technology installed basically to see what type of companies are good. When we put the lens of technology, what we found were companies that have already invested in CRM, like Salesforce and HubSpot. Companies that have invested in marketing, companies that are serious about the go-to-market motion and they have equipped their sales team with the cadence solutions like sales thought and outreaches and sales view of the world.

When we applied those filters, you’ll see, we came up with 30,000 companies. Here are the 30,000 companies where we have 3X chances of winning and our ACV of $30,000. Those are the customers not only our win rates are higher, but those are the customers whose lifetime value is also higher because they’re going to stay with us for the long temr. They’re not going to come and churn which is– The economies like this, your best revenue is revenue that you can retain from the current customers, keep them happy and upsell them on the other products that you have. That was the exercise that we did. As you can see from 30 to 50 billion market, we brought this thing down to 30,000 companies and about 900 million–

Mike: Maybe talk a little bit about that balance of how you guys approached the win rate as a key input and then also least likely to turn in lifetime value because those two things, especially in one particular segment of our business, they don’t always match up. Sometimes the segment, the cohort of accounts that’s easiest to sell is not easiest to renew or vice versa. What was your experience with that? Did those match up well?

Manoj: Great point, Mike. Great point that you bring in. In our SMB sector, for example very small businesses, they’re looking for data and they come in very, very quickly. Their ACV is lower, they come in quickly, you win the higher rate there but then on the other end, they don’t renew. They churn at the much, much higher rate. Given the resources that our sweet spot is here, on the other end enterprise customers, for us, where we are today in the evolution of our business, it takes far more time and the efforts to win them. Yes, their renewal rate is higher but it took a lot for more product and our support team to just support those large enterprise customers. That’s why we try to took it 2023. The beauty of this ICP exercise is you can do it every year because every year your brand recognition is increasing the market, your team size is increasing and your product is maturing.

Mike: That makes sense. we went through a similar exercise and had to wrestle with that one segment, where we had a much better win rate but lower retention, versus another segment where we had a much lower win rate, but outrageously good retention. There’s a flag to be planted there as well.

It’s like, are you going to build around maybe a slower growth organic approach where you might bring on a lower number of customers, but it’s going to be a really healthy base, or somewhere in between? Thanks for the color. That’s really interesting.

Manoj: Absolutely. You can do these exercises, provided that you have solid data. We pride ourselves for having great demographic, firmographic, and technographic data. Recently, we launched our technographic data and that has been the game changer, not only for us but hundreds and thousands of customers that are using and leveraging this directly to us, or through the platforms where our technographic data is there.

Why is this company technographics different? A couple of reasons. First and foremost, we build this data from ground up. The taxonomy that we used to build the technographic data was pretty organic as to how buyers make decisions, how technologies are installed from the infrastructure level, the communication layer, to the application layer, all the way up.

Our buyers, they tend to prefer that way of navigation through the taxonomy. Then if you’re bombarded with 15,000 and you don’t know how to bucket them. Day one, we started the right taxonomy and then we put these 18,000 technology products that we cover today across 22 million companies. On our company side, we cover 22 million companies around the world.

Think about large metrics, a large table of 22 million rows, and 18,000 technology points. You have the most coverage of data available to our technographic stack. The next point was why is this data so accurate? Because of a couple of things. Number one, we have exclusive partnerships with some of the largest resume providers, resume companies, job description companies. We have a huge network of our users who’s contributing the technology-installed data. Then last, but not the least, we have the research layer. When we started the company with the research layer focusing on the content data, company data, it’s the same research team.

The research team is much larger now, but it’s focused on ensuring that the signals that we are getting from different documents and on the free web about the technology installed at the company are validated to the research process before we surface it for our customers and our research on-demand team that stays with the customer throughout the contract.

If the customer’s interested in the technology that we don’t cover today in our technographic data, we are able to provide that service, or if the customer sees that the technology has less coverage of the install base, we are able to increase that. When we have data available for firmographic, technographic, and demographic data, you’re able to segment and find the right ICP.

Here’s a little bit of, how do you keep your CEO and is this my case, myself and the rest of our team as they’re going to market, it becomes easier for everybody once everyone is aligned as to who our ICP is. You make the decisions much more faster. If you get, like in our case, when we get inbound leads coming in, that is less than 50 employees, we take a very cautionary approach to see how much effort should we spend there?

We don’t go and spend our marketing dollars targeting non-ICPs, which are on both sides of this sweet spot that we identified here. At the same time, if Dell comes in, or Microsoft comes in, Google comes in knocking at your door and say, “Hey, we are looking for a solution because we are really not happy with the provider that we have,” we will opportunistically look at it. We will opportunistically look at it, be very transparent about what our product can do for them today, and then share our product roadmap. Having the clarity as to what our sweet spot is, for every part of the go-to-market organization, makes it much easier. Not only for sales, marketing, and revenue operations, think about your product organization. If product organization is clear about who they’re servicing, who they’re designing and developing the product for, it becomes a lot more easier because a product that’s a good fit for the enterprise may not be a good fit for your SMB sector.

Mike: Both in working with lots and lots of customers, also internally having gone through this, there’s also this hidden benefit of just not having to re-litigate things all the time. When you haven’t done this foundational work, you find yourself litigating case by case by case because nobody from the top has put a flag in the ground and said, “This is what’s most important.” There’s all these other benefits of this decision-making rubric that’s created through this work, where all of the people downstream can just move faster, move easier, move better because they don’t have to re-litigate the strategy every twice a day. They can just move forward.

Manoj: Exactly. Which is what we saw in the survey results. Right? Great, with that, Mike,

Identify & Surface In-Market Companies

Mike: I think, so that’s step one. We’ve identified the universe we want to sell to. Then what our data tells us is at any given time, there’s about 15% of that market that we see showing enough actionable research that we’d recommend, like, “Hey, there could be something going on at this particular account.” To put it into Manoj’s dollars, it’d be about 135 million of that 900 million, we think is either in market or is showing enough interest that it’s worth your time right now to go reach out to that particular company. Now, that could flex up or down, depending on your product. If you have a more niche product, it’s lower than 15%. If you have a really mass-market product that almost anyone can consume, it might be higher. Generally, on balance, we see about 15%.

Manoj: That’s clear.

Mike: Next slide. This is a case study, but it also just continues this conversation of acting on that 15%. What we’ve found is that outbound sales or SDR, BDR use case is usually a really simple way to get started with intent data. It aligns with this presentation and the SalesIntel platform. This idea that if we just first start by taking the SDR, BDR resources that we already have, they’re already sending emails. They’re already making phone calls, that work’s already happening. Plugging intent data systematically into that process typically is going to be the simplest way to measure the impact quickly of intent data. What you should see is what the quote at the bottom of the slide says, which is, “We found meetings or dollars or pipeline that we would not have had otherwise.”

That’s that initial we struck of, “Okay, we found revenue we wouldn’t have had.” Once you’ve done that, and how you do it is vast. You could do it through your CRM, you could do it through a sales intelligence platform. You can do it in a lot of different ways. Once you’ve done that, then it becomes this exercise of expanding those use cases to support this process, to support this data-driven approach. How do we take the same data strategy from ICP to intent data and plug it into digital advertising or plug it into social advertising, or even things like site personalization, Google search, et cetera? It’s about proving that this approach works and then amplifying it with more use cases as you go.

Manoj: That makes sense. The limited dollars that you have within your ICP focus on the companies that are already showing positive signs and positive intents.

Mike: Right. Luckily when we started Bombora, we had to teach everybody what intent data was, which is fun, but a whole different exercise. Now, its intent data is hardened in place, as a part of a modern B2B go-to-market. Still say only about 30% to 50% of the market’s really using it in a meaningful way, but everyone’s aware of it. They know what it is, and now it’s a little bit like, “Oh, there are all these different types of intent data and how do I know which one to use and how to get started?” This is just designed to give a really high-level overview of the Bombora approach versus what is more commonly natively available in the broader ABM and some of the other sales intelligent platforms, which is sourced from Bidstream.

From a high level, Bombora has gone out and handcrafted one-to-one relationships with media companies, event companies, lead generation firms, even brands themselves and effectively created a proxy for the B2B research web. The Bidstream data comes from websites that auction off their advertising. These typically are much broader websites. The data that flows out of that auction process is what flows into these Bidstream-based intent data products.

Mostly for folks on this call, you probably don’t care. You want data that works. You want data that’s getting you into deals. We go through the time of curating the B2B research web, so that it has that effect so that it’s real, and it’s accurate, and it gets you into deals. Whereas, the Bidstream stuff struggles to do that because it’s just coming from broader websites that auction off their ads. This is a technical topic, and if folks have more questions, happy to dive deeper.

Manoj: Thanks, Mike. Thanks. I always tell people about intent data. It’s better to get no intent than to get the bad intent. Think of you selling your sellers, and your marketer is in a wrong direction.

Mike: Yes. You pay for it. Bad intent data is extremely expensive, because A, you pay for it, and then on top of that cost, you’re sending resources in the wrong direction at times.

Target the Right People

Manoj: Absolutely. Here’s a buyer’s guide, if you’re interested just drop a note, and our marketing teams will share more with you on this. All right, so moving right along. Now that you’ve defined your ICP, applying the firmographic, demographic, and company technographics there, you’ve put the intent layer on top of it so you know exactly who’s in the market or showing interest of your solution. What’s next? So far, you have identified the companies. Companies don’t buy, it’s the people in those companies that buy.

That’s a third step. Find your people. In buying companies, as we all know, depending on which research you look at, it’s 7.2 or 8.5, 9.2, users, buyers are involved in any B2B buying decision. In most of the platforms you see, if you’re buying committee is comprised of let’s say six people, you’re going to see maybe you have one buyer you have access to, and to two influencers. The other folks are just not there.

You can’t take the ABM, ABX strategy and make that effective, because your marketing has done all the hard work to find the accounts that are the right fit for you, or in the market, and now they have given you a lead. Salespeople can only be effective if they have the right decision-makers and the right influencers to get in front of them and have the right conversations. Filling the gaps. Most of our platforms, you just have gaps as we saw in the previous picture that out of 6, you only have 2 or 3 decision-makers, and the influencers available.

How do you go about filling in the gaps? How do you go about ensuring that the people that you’re talking to are the right people? How do you ensure you have the right contact information for those people? For our clients, obviously, they have access to our high-quality, human-verified data day one, and then they have access to our research team. We call them to research on demand that they can go and request, to fill in the gaps, and also verify the context that we don’t have in our platform.

Let’s be honest, with hundreds of millions of folks in the professional world, there’s no one platform that’s going to have all the data. When you invest in any other platform, you are out of luck when you don’t have a verified contact, or verified company, or a technology that you don’t have enough coverage on.

With the SalesIntel platform, you have this research on-demand service available to fill in the gaps, at the same time, do the verification of the data. With that, your sellers have access to people that they can reach. This is what we call actionable data. Data that you can use to have a meaningful conversation about your product, your services with the companies that are in your ICP, and currently showing the intent.

Right Message, Right Time

Mike: Thanks, Manoj. We want to talk a little bit now. ICP defined, we know what percentage of that is in market. We have the contacts now that we want to go after, but what do we say to them? If you go to the next slide, we can get into that a little bit. It’s this hidden benefit of intent data that people don’t think a lot about. The hammer-to-nail use case is prioritization. Who should I care about right now, this week, on this day? Who should I reach out to? What the data’s also telling us is what to say to them. You might work at a multi-product company. You might work at a company that has multiple business drivers that lead to a customer buying your product. Example I like to use is a Telephony company, they love selling to businesses that are expanding into new office locations.

It’s one thing to know that a company’s in market for Telephony, it’s another to know that it’s because they’re expanding. That’s the kind of information that’s hidden within the data that when properly surfaced, you can take advantage of. Next slide. Not many of us these days are in this position but there’s also just if you have the dollars to build your brand and to invest in building your brand, there’s also just knowing that 85% of the market that’s not in market right now, they are ready for that brand message.

Just being able to segment your list by those that are ready for a branding message versus those that are ready for a more down-funnel demand-oriented message is highly efficient. I wish everyone on the call, these big squashy media branding budgets we were throwing around, that’s not the case right now but as those brand budgets start to come back, not giving a branding message to a company that’s showing a tremendous amount of buying behavior is a better way to do that branding. Excellent.

Manoj: Good. Great point, Mike.

Mike: All to say that this intelligence, it’s not just from the intent data. We have these leads in our system and applying all of the ICP data as well as the topic-based intent data, that gives us all this richer lead profile that ultimately is going to allow us to automate it down different tracks and to measure the validity of these different cohorts that this data allows us to create. If we know companies that have installed a certain technology, they’re going to get a different message because maybe your product aligns to that technology in a different way. Not only can you automate a message that aligns with that technology, but you can also measure that cohort against other cohorts. Applying this data on the lead level and building process around, it’s very powerful.

Predictable Forecasting & Planning

Manoj: Couldn’t agree more with you, Mike. Folks, we shared the importance of figuring out who the ICPs from the TAM, who’s in the market within those ICP, and who within those companies that in the market that you should talk to. The importance of having that research arm available so that you can get the right contact information and the right message. The topic is about predictability. How do you plan for your sales capacity, when to make the realistic decisions about, should we hire new AEs or not? What is the right time to get those AEs or not? This planning, if you’ve done your ICP planning well, then you are able to answer those questions.

The CEOs, if you’re the CEO, this is a useful exercise. If you are the sales and marketing leader on this webinar or the revenue operations leader, this is a great exercise to go through with your CEO so that their decisions are rooted in the data. The decisions are rooted in those ICP analyses to show how many companies are in our ICP of those at any given point of time. As Mike mentioned, on an average, 15% of the companies are in the market looking for a solution like yours. Then from there, the number third bucket in the planning process is all about your sales process and your deal dynamics. What’s your ACV? How long does it take to close the deal? What is your conversion ratio from the lead to close? What’s your conversion ratio from lead to the qualified numbers?

Once you had those numbers, in our company at SalesIntel, we apply the 70/30 rule. What is the 70/30 rule? Just unpack that. Our 70/30 rule is, it is key to the healthy outbound motion. 70% of the time of our outbound sales results into 30% of the new logo. 30% of the time, 70% of the logos are brought in through inbound, but at the end when you get it to revenue, it’s almost an even split. It’s just 50/50.

The reason behind that is the outbound motion is very intentional. The ACV tend to be higher, whereas inbound, the ACVs are lower. They may close a little faster than your average time that from initial contact to close sales cycle. That’s how we define our sales cycle. We apply the 70/30 rule and based off of that, we make the planning. If all of our reps are living off of those 30 % efforts and inbound is filling in and they’re hitting their quarters, that means it’s done for us to go higher new additional reps on our AE Team. If we’re not, then we need to stay straight forward. Not only this exercise that we went through ICP analysis, laying over the intent data is important for you to increase your win rate.

It also helps in the planning process and in forecasting process. Last, the demand center. This is the cross-function and we saw from a survey that companies meet less than a quarter, sometimes once a quarter or less than a quarter. We believe that building this demand center, which is a cross-functional that takes you from ICP target and territory planning to generational pipeline and progression of the pipeline. Then the measurement of what worked or didn’t work. Bringing the full loop back in your planning is going to help, not only your sales and marketing leaders, but across the board, your executive leaders, sales, enterprise marketing, revenue, operations, and product teams are going to stay aligned.

Webinar Q&A

What is the aim for SalesIntel to capture mobile numbers?

Ariana: Manoj, this would be a great question for you. For telephone outreach, mobile phone numbers are key to reaching and conversing through cold calls. What is the aim for SalesIntel to capture that data for contact? I think what this person is getting at specifically is, what is SalesIntel’s mobile coverage? I’m going to go with that. I think that’s what they’re asking.

Manoj: We have the highest coverage of mobile phone numbers in the industry. Depending upon the segment of the market that you’re going after, we may have 40% of your decision makers’ information available on the mobile phone, all the way till 90%. There’s a range. It all depends upon who you are going after.

Many people on the Wizard of Ops Public Slack Group Community are saying, “Intent data cannot be trusted.” How would you respond to this?

Mike: I think it reminds me of this idea of arguing without disagreeing. I’d say like, how are we defining trust? Our submission would be that if you just call/email identical process, a hundred companies that we showing increased research and a hundred companies that we don’t, that there would be lifted in that exercise like 98% of the time. It’s not perfect. Sometimes there’s offerings and holes and data that can be dodged.

A lot of times what people are reacting to is, I called this account which they said had intent and they’re not in market. It’s an exercise of scale and it’s an exercise of being powerful directional data. It’s a matter of I challenge us to make sure that we’re looking at the exercise the same way, which is hard to do in this medium, but happy to have anyone reach out. We can talk more about it.

How should a company approach intent data from an opt-in perspective?

Ariana: Absolutely, that’s a great one. This is also one that I would love for both of you to weigh in on because it really speaks to how to actually use this intent data. How should a company approach intent data from an opt-in perspective? Intent is only at the account level, so it’s hard to know the exact person who was doing the search that the intent picked up. Are you aware of any methods or programs to reach out in mass email methods and entice marketing opt-ins?

Mike: Yes, I think I’ll love to hear Manoj’s take too because this then swims over into the contact world, but on the intent data level, there is geodata. To the degree that you can, depending on how you’re operationalizing the data, and especially if you’re selling an enterprise where you’ve got multiple locations, explore how you can surface that geodata. It’d be like, okay, company X seems to be showing increased research in, let’s say a widget as a product. If providers can also tag, that seems to be emanating from Southern California or that seems to be emanating from the Chicago metro area. Then it makes that contact hunt a little bit easier, but Manoj, we’d love to hear how [crosstalk].

Manoj: Great point Mike. Great point, I think there two lenses you apply on the intent data. One, with the location. Dell could have 16 offices, which location is this intent coming from and then, you know your buying center. Who makes the decision? Who’s the influencer? We segment all the contexts based on the title, and then further level and department, if you know that your product is purchased by directors or VP-level folks in finance, then all of a sudden, you’ve narrowed down. In Chicago office of this company X, intent is coming from and we sell it to finance director and VP so your subset of people that you want to talk to becomes very manageable.

What is the 70/30 rule?

Ariana: We’ve got a lot of more questions in here as well. Let’s see. in the 70/30 rule, you said 70% of the time. I think we’re just getting some clarity on that. Manoj, would you mind going back to that slide for us?

Manoj: Yes. Let’s go back to that slide. It’s about a 70% of your– so 30% of your new logos are going to come from 70% effort from your sellers as your BDR, as your AEs. Opportunities that are driven from outbound channels, whether it’s in outbound emails, outbound phone calls, social touches. 30% of the times, your logos, your 30% of the efforts that you’re spending, the logos that are coming in, new logos are coming in from 70% of your logos are coming in from 30% of the efforts.

Is that clear or should we unpack further? Let’s just say, you won 100 accounts in a quarter. 30 of them are going to be as a result of your outbound team, 70 of them are going to be a result of your inbound teams. If you look at the amount of efforts by your sellers, by your sales organization, 70% of times, they are the ones who are making the calls. They’re the ones who are making the outreach.

When creating the SAM and SOM, are you using existing base of customers or using market data for new logos?

Ariana: Well if that didn’t clarify it enough, please let us know. Come back in through the chat. All right, here’s another great one about really identifying and sizing your market. When creating the SAM and SOM, are you using existing base of customers or using market data for new logos?

Manoj: Both. If you have a running business, you can take the characteristics, same your demographic, firmographic, and company technographics off of your current base and see where do you have the highest retention rates. When we looked at our data last year, we looked at the customers where we had the two years, three years, four years of retention, and we applied those firmographic and technographic data off of that. If you have data available from your current customers long enough of history, then that that’s where you start. Otherwise, you start with, as Mike mentioned, put the stake in the ground and then continue to define it.

What data partnerships does the research on-demand team leverage in order to aggregate the necessary data points to define ICP and identify if an account fits?

Ariana: Absolutely. Then we have another or actually, I’m going to jump up to here real quick because I think we had some questions about this Manoj and then Mike, I’ll have one for you next. What data partnerships does the research on-demand team leverage in order to aggregate the necessary data points to define ICP and identify if an account fits? Maybe let’s clarify research on demand, and how the sales intel tools work there, Manoj.

Manoj: Yes, absolutely. At SalesIntel, we have our own data and the technology, and the sources of data that we get the data from. Let’s see what’s a good example of a contact data. We have over 14 million users that use our mobile applications to scan business card at different conferences or manage their address folks. The contact data comes from there.

As we all know, that data is noisy and gets old. We have then, our data pipeline, that is based on AI as well as NLP engines to curate it based on a signal of the data. AI buckets that we call it as machine verified data. AI buckets that contact data at certain level of accuracy, but we can’t give the data to sellers to go make the calls. Imagine if the data is 80% accurate and you’re making 10 calls and two out of every calls are going to the wrong person.

We believe that work should be done by someone like us. We put a research team on top of this machine-verified data so that the data that we give to your sales and marketing team is 95% or higher in accuracy level. Hopefully, that answer the question. We collect the data from different sources, apply the technology on top of it, fully knowing that it’s never going to be 95% ready. That’s why we put the last layer of human verification on top of each layer of data that we own and operate.

Ariana: Absolutely, so the research team helps fill in the gaps, and then by using SalesIntel, you’re able to determine your own ICP.

Manoj: That’s correct.

How often is Bombora Intent Data updated in the SalesIntel portal?

Ariana: All right. Mike, here’s that one for you. Coming from Adele, is there a way that SalesIntel Bombora can show the date that the intent data was updated?

Mike: Yes, good question. Manoj, you can speak to how it manifests in the product, but our approach is to update the data on a weekly basis. Our idea is we’re tracking a company and they’re interested in a particular solution. We want to look at that over a long period of time and take these weekly snapshots and surface a weekly score. This is a conscious decision. What would be bad is if every time we saw a little activity or God forbid, one activity, we would surface that signal to our customers and they would be chasing every little thing that happens on the internet. Internet’s a big place, so what we try to do is curate it and say, “Okay, these weekly snapshots are the right cadence to make a declaration as to a company’s relationship with the solution.” Unless, there’s something different SalesIntel is doing, the data is updated weekly.

Manoj: We refresh as we get our data from Bombora every Sunday night, I believe. There is a refresh, so Monday morning, you’re getting fresh intent data within our platform.

Ariana: I love that point, Mike, of it’s not just every little update that comes through. I think that’s even in our own best practices that we recommend having at least a few intent topics that really show that signal because if someone’s searching for just one thing, that’s how you get– like the Green Bay Packers searching the oil and pipelines built that happened like months ago. If you’re looking for just one thing, it can be confusing.

Mike: It’s a cross to bear for us, and we probably do a better job, but these best practices are key in downstream success. We have thousands and thousands of indirect customers, but you’re exactly correct. The curation of the signal is important. If you’re selling widgets, there are probably lots and lots of different things that go into researching and buying widgets. Curating the right signal and then acting on that signal at the right threshold of aggressiveness of that signal is important. If anybody is struggling with that or needs some help or thoughts, feel free to reach out to me.

How do you forecast revenue predictability with accurate data?

Ariana: Yes, I think you even have a guide for that. I’ll do a little plug for you on that one. I know there’s an intent selection guide for how you go through and actually determine what are the best topics for you. That’s definitely great information if you all aren’t familiar with that yet. Last question that we’ll get through today because we are starting to slow down, was just a general comment about, please say more about forecast predictability. Mike, Manoj, would love to hear you both speak on how having great data and really leveraging account and technographic, firmographics and intent data can help you better forecast your success in 2023.

Manoj: Mike, do you want to touch on that?

Mike: Yes, we look, and I think what Manoj was getting at earlier is this idea of if you systematically go through that process of ICP and then you consider that 15% in market, you can do math in terms of how many reps you’re going to need to go hit that number and you’ll have these great indicators along the way of when it’s time to add more reps. Another way, folks are overlaying intent data, and this sophisticated use case is creating a health score against their pipeline. If you’ve got a pipeline of, to keep it simple, 100 accounts, you can look at the intent data across those 100 and associate that with the intent data that happens before close one and start to get a good idea of how healthy that pipeline is. If that helps.

Manoj: I’m happy to share our models where we take all this data in a Google Sheet. Please drop me a note and we’ll be happy to do that.

Ariana: All right. Then we also have one person asking for your contact info. I’m going to send that along to them so that way everyone can get it. Then Manoj, would you mind going to our last slide for the day?

Manoj: Yes.

Ariana: Awesome. Thank you so much. We also do have a special offer that’s running through SalesIntel, but of course, powered by Bombora for the intent data. A free offer to see five companies showing intent in your ICP today. You can reach out via this link. We’ll have people reaching out to you to make sure you can take advantage of this free offer and actually see who’s showing intent and see if you can’t move people in that right direction. Thank you again, Mike and Manoj for joining today. We had a lot of great questions. Thank you audience for being so engaged. You’ll get a copy of this recording in your inbox soon and we hope to see you back, everyone. Have a wonderful day.

Manoj: Thanks, everyone. Thanks, Mike.

Ariana: Bye everyone.

——–

Create Your Sales Pipeline Stronger, and More Consistent!

The sales pipeline serves more than just the sales team; when the whole business is focused on revenue targets, every team succeeds. Whether your company is being disrupted by a new rival, a significant opportunity, an industry upheaval, or an internal strategy shift, utilize these recommendations and the sales pipeline template to anticipate your deals.

Developing processes and setting new definitions will enable powerful collaboration among your go-to-market teams and stakeholders. This can spark and revive an otherwise stagnated pipeline, bringing it back to life.

There are so many things that go into driving your revenue. And there’s a lot of pressure on revenue leaders to keep up with the latest trends and techniques – even though the B2B landscape is constantly changing, and best practices are only good for so long.

We hope the above transcript will help revenue leaders learn proven best practices and industry knowledge from our experienced B2B practitioners.

If you’d like to watch the recorded webinar, watch the replay