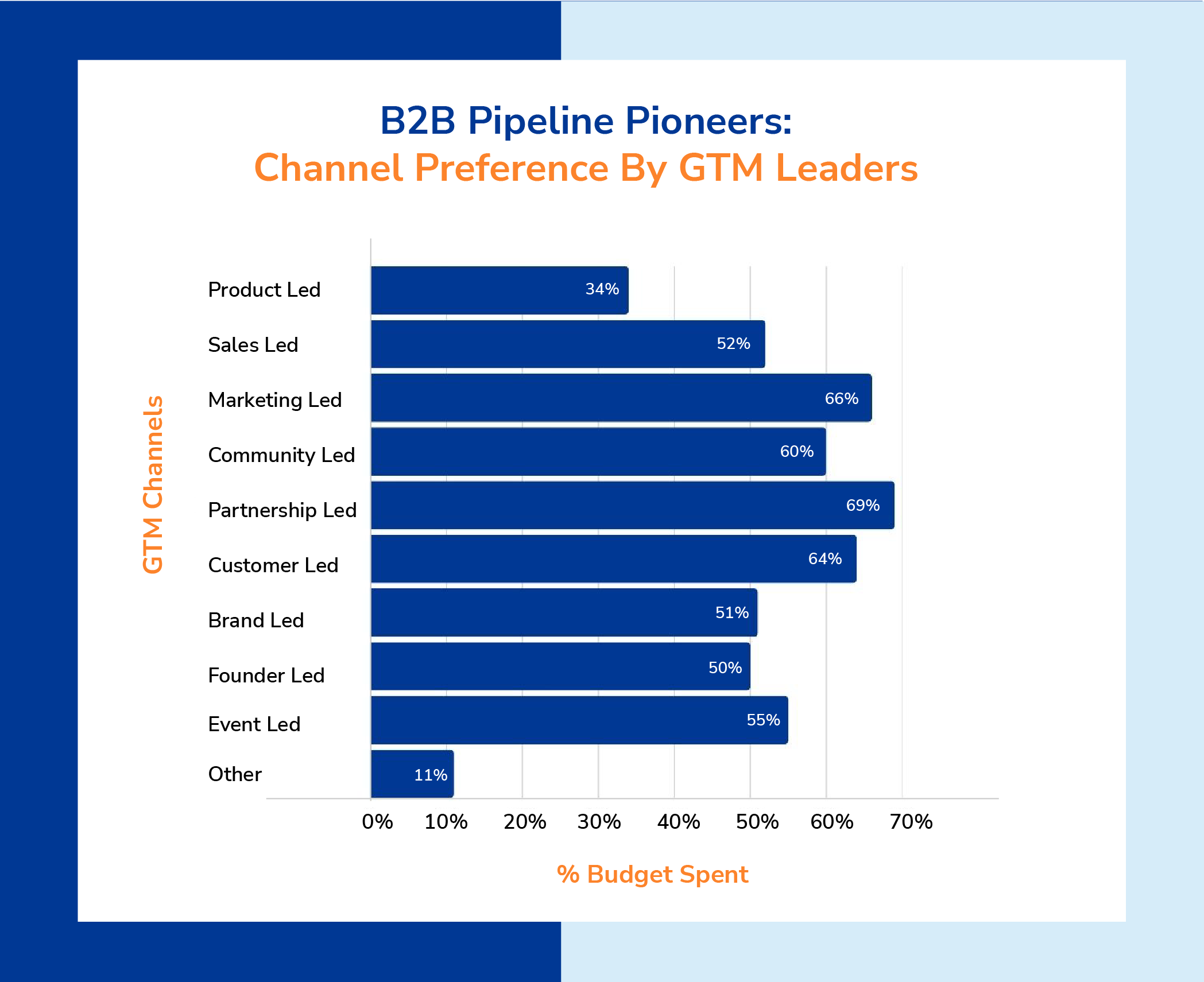

For years, Product-Led Growth (PLG) has been hailed as the future of B2B sales. Companies like Slack, Dropbox, and Zoom have demonstrated how a product-first approach can drive adoption, reduce acquisition costs, and scale revenue efficiently. But despite its popularity, recent insights from our Pipeline Pioneers Podcast Series reveal that only 34% of GTM (Go-to-Market) leaders have embraced PLG as their primary strategy for pipeline generation.

This statistic raises a crucial question: Is PLG losing its effectiveness, or are companies becoming more strategic about when and how to use it?

While PLG remains a powerful strategy, its effectiveness depends on various factors, including business model, product complexity, and customer expectations. In this blog, we explore why some companies still swear by PLG while others are shifting towards a more hybrid approach, blending product-led and sales-led strategies.

The Rise of PLG: Why It Became the Go-To Strategy

PLG became popular because it empowers users to experience a product’s value before making a purchasing decision. Unlike traditional sales-led approaches that rely on outreach and demos, PLG puts the product front and center, allowing users to self-educate and self-onboard.

Here’s why PLG gained significant traction:

1. Reduced Friction in Customer Acquisition

Traditional sales processes often involve long sales cycles, requiring extensive engagement with sales representatives. PLG eliminates this friction by allowing users to sign up, explore the product, and realize its value on their own. This self-serve model improves conversion rates and shortens time-to-value.

2. Lower Customer Acquisition Costs (CAC)

Since PLG prioritizes organic growth, companies can scale without heavy investments in outbound sales teams. Instead of paying for lead generation and direct outreach, businesses rely on viral loops, referrals, and in-product upsells to drive expansion.

3. Scalability and Automation

PLG allows businesses to grow without scaling their sales teams proportionally. Once the product is optimized for self-service, companies can acquire and convert users with minimal human intervention. This makes PLG an attractive model for SaaS businesses targeting SMBs, startups, and developers who prefer a hands-on trial over sales conversations.

4. Stronger Product-Market Fit

PLG forces businesses to prioritize user experience. Since customer acquisition depends on product adoption, companies must continuously refine their features, optimize onboarding, and deliver an intuitive experience. As a result, PLG-driven companies often achieve a more natural product-market fit.

These benefits explain why PLG became the preferred go-to-market motion for many SaaS startups and why established B2B companies started experimenting with PLG elements in their sales processes.

The Limitations of PLG: Why It’s Not a Universal Solution

Despite its advantages, PLG is not a one-size-fits-all strategy. Businesses that rely entirely on PLG often encounter significant roadblocks. This is why 66% of GTM leaders still prioritize other models for pipeline generation.

1. Not Suitable for Complex, High-Touch Sales Cycles

PLG works best for simple, self-serve products where users can quickly realize value without needing extensive guidance. However, many B2B solutions—especially in enterprise software, cybersecurity, and AI-driven platforms—require in-depth customization, onboarding, and support.

Example: A CRM or ERP system typically involves multiple stakeholders, complex integrations, and tailored implementations. A self-serve model alone is unlikely to drive conversions at the enterprise level.

2. Challenges in Monetization and Upselling

While PLG accelerates user acquisition, converting free users into paying customers can be challenging. Companies that rely on freemium models or low-cost entry plans often struggle with monetization.

- If users don’t see a compelling reason to upgrade, they may remain on the free tier indefinitely.

- If pricing is too aggressive, PLG companies risk alienating users before demonstrating value.

PLG companies must carefully design pricing models, premium features, and in-app upsell mechanisms to maximize revenue.

3. High Costs of Scaling PLG

At first glance, PLG appears cost-effective because it reduces sales overhead. However, scaling a PLG motion requires significant investments in product development, data analytics, and automation.

- Companies must continuously refine onboarding experiences to improve activation rates.

- A/B testing, usage tracking, and behavioral analytics are crucial to optimize conversion funnels.

- Support costs can increase as users require assistance at scale, even in a self-serve model.

4. The Need for Hybrid Approaches

Many businesses have realized that a pure PLG strategy is not always sustainable. To bridge the gap, they have adopted hybrid models, blending PLG with sales-assisted and marketing-led growth.

- Product-Qualified Leads (PQLs): Some companies allow users to explore the product but introduce sales engagement when key signals indicate a high intent to buy.

- Sales-Assisted Expansion: While initial adoption is self-serve, expansion into enterprise accounts often requires dedicated account executives.

- Content & Community-Led Growth: PLG companies often supplement product virality with content marketing, webinars, and community-building to drive deeper engagement.

This hybrid approach helps companies retain the efficiency of PLG while addressing its limitations in enterprise sales and monetization.

Evaluating PLG: Is the Hype Fading or Evolving?

Rather than fading, PLG is evolving into a more nuanced, strategic approach. The model is no longer seen as a standalone strategy but as a complementary motion within a broader GTM framework.

Where PLG Still Excels

PLG remains a powerful model when applied in the right context. It works exceptionally well for:

- Self-serve SaaS products with a clear time-to-value.

- Developer tools and APIs that thrive on hands-on exploration.

- Freemium and low-cost products where users can upgrade easily.

- Products with viral and network effects (e.g., Slack, Zoom).

Where PLG Falls Short

Companies targeting large enterprises, regulated industries, and high-touch sales environments often find that sales-led and marketing-led strategies outperform pure PLG.

- If deals require multiple approvals, legal compliance, or heavy customization, a sales team is essential.

- If the cost of acquisition is high, companies need a structured sales motion to ensure profitability.

For these reasons, many companies that once pursued PLG exclusively are now integrating account-based marketing (ABM), intent data, and sales intelligence into their GTM strategies.

Final Thoughts: PLG is Not Dead—It’s Maturing

The fact that only 34% of GTM leaders prioritize PLG does not mean the model is failing. Instead, it reflects a more balanced and strategic approach to pipeline generation. Businesses are recognizing that PLG works best when paired with data-driven sales strategies, intelligent automation, and human interaction where needed.

Key Takeaways:

- PLG is still an effective growth lever, but it thrives in specific use cases rather than as a universal solution.

- Many companies are adopting hybrid GTM strategies, combining PLG with sales-led and marketing-driven approaches.

- The future of PLG is not about replacing sales but enhancing it with product-driven insights and automation.

For companies looking to scale their B2B sales pipeline, the answer is not choosing between

PLG vs. sales-led growth—it’s about aligning both strategies to maximize conversion and revenue.

Would you like to learn more about how top GTM leaders are navigating these shifts? Listen to the latest episode of our Pipeline Pioneers Podcast for deeper insights.