You always want to assume that your relationship with a new vendor will be based on trust where both parties honor their word. However, an alarming trend is becoming more prevalent where the fine print is being combined with aggressive litigation of customers to enforce the terms of contracts that many customers didn’t realize they were agreeing to.

In an ideal world a contract can be as simple as a plain-language document that outlines expectations for both parties, gives both an equal right to take rectify conditions or terminate the agreement if those expectations are not met, and keeps the scope and limitations clear. Contracts don’t need to be scary. Unfortunately, you can’t assume everyone operates in an open and honorable fashion so you need to be careful when it comes to shady contract practices, especially in the data industry.

What Do We Mean By a “Shady Contract” in the Data Industry?

Some data partners, engaged in a vicious circle, put profit before customers. As a result, they obscure details in their sales conversations and contracts that often take the customers by surprise. A “simple” deal as discussed in their sales conversations, is not so simple when they receive a data contract with super fine print. When we say shady contracts, you might think of early-stage companies desperate for any advantage to grab market share. However, it may take you by surprise that the list of data partners following unethical business practices includes some of the biggest names in the industry, including one that recently went public.

Why Should You Read the Contract Closely?

If you assume that what is written in the contract matches what was said in the final meeting with your account executive, you may be in for a nasty surprise! There are many reasons why reading your contract carefully before signing is essential.

Contracts often have legal terms in them. Unless you are familiar with the legal terms, you may find clauses that are difficult to understand and language that may confuse you. These legal terms don’t lend themselves to a quick and superficial review. Give yourself a few days to ensure you have sufficient time to give a detailed look at the contract. Ask questions and redline the document as needed. You always want to believe everything will work out well with your new solution but it’s important to ask “what if?” scenarios that may occur under a variety of circumstances, including if the product doesn’t work out as a solution.

Obviously, you will be excited to get access to the data and put it to work for your lead generation and prospecting activities. However, don’t treat the execution of the contract as a formality to be rushed through. There are too many instances where customers have been burned by not examining the contract closely enough. Ideally, ask a licensed attorney to review the final contract.

Additionally, give special attention to the fine print, addendums, links to external resources, etc. If a vendor is trying to obscure a detail this is where they will hide it.

Ignoring the Fine Print in Your Contract Is Dangerous

Here are four reasons why you should read every single word that’s part of your contract.

1. The Fine Print is Contractual

The words in the fine print are as binding as other words in the contract. They are part of your contract. The fine print or referenced documents often contain language that may specify the precise interpretation or enforcement of specific details pertaining to the contract – “the grey area”.

If you end up in court over your contract, the fine print can determine how the judge should view the most important portions in contention. The fine print part of your contract often contains valuable or hidden information that you might not be aware of.

2. The Fine Print May Not be What You Think It Is

Even if you are signing the contract for the second time with your data partner, even the fine print needs to be reverified. It may happen that the fine print may not be the same fine print as your last signed contract.

When you don’t read the contract thoroughly, you won’t know if the person who drafted it made a mistake or inserted a condition that you didn’t agree to. Read your contract carefully and make sure that each clause is consistent with your understanding of the agreement. Reminder – every part of your contract is important and enforceable.

3. The Clauses You Ignore Could Hurt Your Business

Nothing is as disheartening as knowing that what you were committed to in the meetings and on the sales call and what is written in the contract don’t line up. Your data partner may obscure details and add them to the contract in the fine print. It can get worse when you realize that parts of your contract are invalid or your rights are limited because you failed to read the fine print.

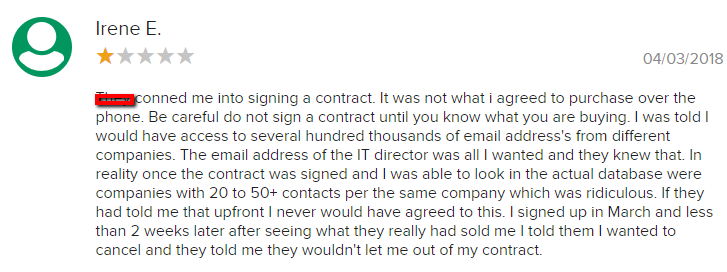

For example, if you have a verbal understanding of what will be available in the data platform but after executing your contract come to find the coverage doesn’t live up to what was promised, a merger and integration clause may prevent you from introducing evidence of your oral agreement with your data partner in court.

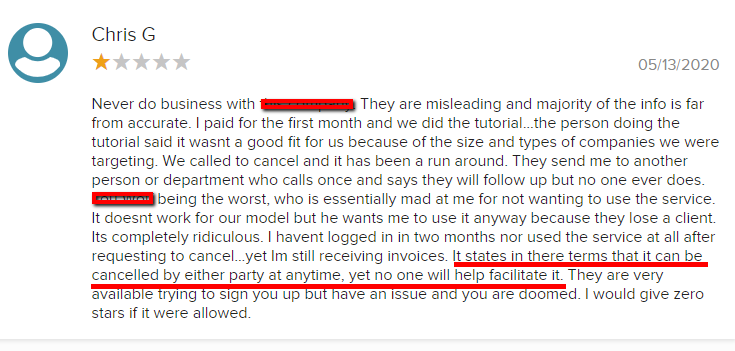

In fact, this is exactly what seems to have happened with a customer of a publicly-traded data company. The complaint forum is full of unethical contract practices that leave customers frustrated, trapped, and helpless.

An arbitration clause is one of the most commonly used in the fine print of today’s contracts. Although most people skip over it thinking that arbitration must be in their best interests, agreeing to resolve disputes through arbitration can severely limit your rights if a conflict occurs. Such agreements usually mandate that you settle all conflicts by arbitration and also set out the arbitration facilities that you will use (of course, those chosen by the other party).

Forced arbitration provisions limit your constitutional right to file a lawsuit and push you into a process that can be expensive and time-consuming. The arbitration may be a fantastic choice for settling conflicts, but it should be a voluntary option. When your deal contains a fine-print arbitration clause, talk with your adviser about it and your options.

4. The Fine Print Often Dictates the Terms in Your Contract

If you see that your data contract has capitalized terms, it means that they are given specific meaning in the contract. Do not consider the generic meaning in normal language. If the same term is written in lowercase, then you can consider the generic meaning. When you see capitalized terms, you will find the meaning where the capitalized word first appears in the contract, usually in quotations. Thus, be careful while reading the capitalized terms and watch out for the section where defined.

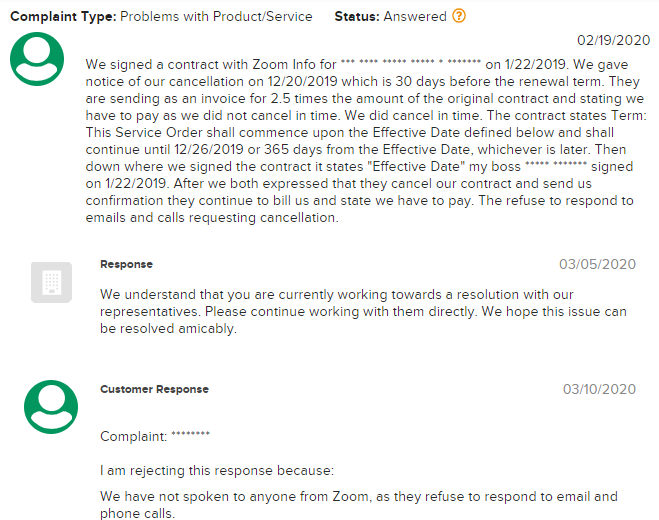

Watch for Auto-Renewal Clauses

An auto-renewal clause is a part of your data agreement that is written into the contract that permits your data provider to extend your original contract and to continue invoicing you without needing your renewed approval and often includes substantial cost increases. You can learn more about the dangers of autorenewal traps and how to avoid them.

If you want to terminate your contract after it is renewed automatically, you can face several cancellation costs, including an early termination fee (ETF). In other words, they will also charge you a part of the remaining contract or even hold you to the full value of the agreement.

At SalesIntel, we believe in our ability to provide data accuracy and the best customer service. As a result, we never force our customers into contract auto-renewals.

How You Can Ensure You Don’t Get Surprised by a Contract’s Terms?

You should check for clauses that specify how the contract will be terminated in the event that it does not perform as expected. Sometimes if you are locked into a data contract and if you are dissatisfied with the quality of the solution, your data partner may not allow you to get out of the contract or it can be a pain in the neck. A publicly traded data provider received a lot of customer complaints where their clients were not able to cancel the contract.

As a result, they started looking for an alternative.

Wondering how we can be so sure about this?

Because they switched to SalesIntel. In fact, many of our customers have made the switch to SalesIntel after terrible customer experiences with other data providers.

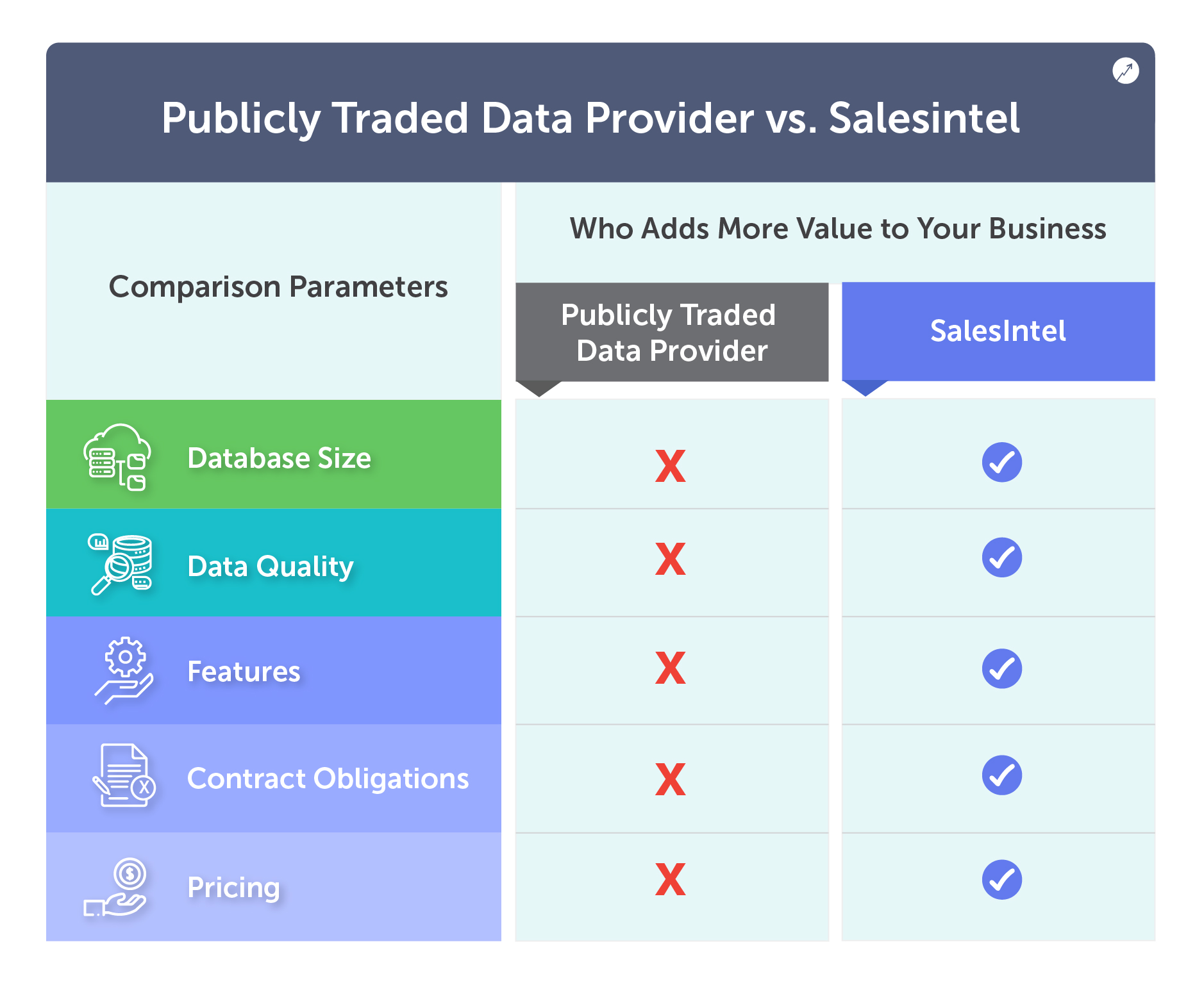

Here’s a quick comparison between a publicly-traded data provider and SalesIntel based on different parameters.

(Read: ZoomInfo Vs SalesIntel detailed Comparison)

Long story short, even though we all want to believe all parties in a business relationship are behaving ethically and trying to advance both party’s interests, it’s clear this isn’t a safe assumption. So read your contracts carefully, check the reviews of existing and previous customers with an eye towards complaints about contracts, litigation, and shady practices, and in particular watch for clauses that lock you in such as auto-renewals. And your best option is to always choose a data partner who is committed to maintaining transparency throughout the relationship.