When business owners (mostly from the SMEs) sign a data contract, they do so in good faith, assuming the contract represents what the salesperson said to them. Often, that is not the case. What follows can be a frustrating, hair-raising experience that can leave even a calm and composed person ready to snap.

We are talking about getting caught in the auto-renewal trap buried in your data contract. Let’s start with understanding the clause.

What Is an Auto-Renewal Clause?

An auto-renewal clause is a component of your data agreement that is written into your contract and allows your data partner to extend your original contract and continue to bill you, without requiring your re-approval, and often including significant cost increases. To put it another way, if you signed your contract and it has an auto-renewal clause, you will be on the hook for the next one, two, sometimes even three years if you don’t cancel within the window of time stipulated in your contract.

Normally, your window of opportunity is about 90 days before the end of your original contract, but don’t expect them to send you a reminder notice. However, not all businesses prefer auto-renew you for multiple years. Many instead switch you to a month-to-month agreement minimizing the financial impact should you realize you have renewed when not intending to.

Data Contract Auto-renewal – Boon or Bane for Your Business?

It is annoying when your data contract gets auto-renewed as you may have never received an auto-renewal reminder email and you had no intention of renewing or continuing with the same data partner. This is particularly frustrating when so many SaaS offerings send auto renewal emails to their clients 30-60 days before the opt-out date.

Eh? What? Why?

It is expensive to acquire new customers so it is nearly always cheaper to retain your existing customers than it is to go find and close replacements. So no company likes hearing a customer wants to part ways. Companies will often try just about everything in their power to retain their customers auto-renewals are an effective strategy to avoid difficult renewal conversations and tie customers up for an additional year(s). All too often you never received a renewal email or simply forgot to cancel and next thing you know you’re staring at a hefty invoice or credit card bill.

People are often busy with work and don’t have enough time to go through their contacts with as much attention and care as the complete contract stating the auto-renewal clause. You only have to see the reviews of some of the most recognizable brands to understand what we mean.

Early Termination Fees

So what if your business situation changes or you are totally dissatisfied with the data accuracy and want to get out of the contract? If you choose to break your payment processing agreement after it renews automatically, you may face multiple cancelation fees, including an early termination fee (ETF). In other words, they can still charge you a portion of the full contract or even hold you to the full value of the contract.

Must Read: ZoomInfo vs SalesIntel: Why SalesIntel Wins!

How to Avoid Auto-Renewals?

Alright, so you’re sufficiently concerned about getting stuck in an auto-renewal trap. How do you avoid it? You just have to work out the details before you execute your contract. Remember, ultimately you are in control of which data partner to work with, so if they don’t want to be flexible, that’s their loss. Don’t settle for anything less!

Here are four steps to help you avoid the expense of an auto-renewal clause and keep control where it belongs—with you!

1. Read Your Contract

You are busy and the salesperson’s probably putting pressure on you to sign yesterday. Assuming you know what’s in the contract and just signing the agreement is easy. By this point you know better.

Make setting aside the time to thoroughly review the contract a priority and don’t let your rep pressure you into signing before you are ready. Grab some coffee, then take your time. In particular, take note of how long your data agreement is, and pay particular attention to the cancellation procedure. Be sure to click through to any additional supporting documentation that is linked to in your contract as well. No matter how nested those details are you’re still likely to be liable for what you agree to and sign.

Not reading the contract carefully or not paying enough attention can leave you stuck with your data partner impacting your data quality as well as your ROI.

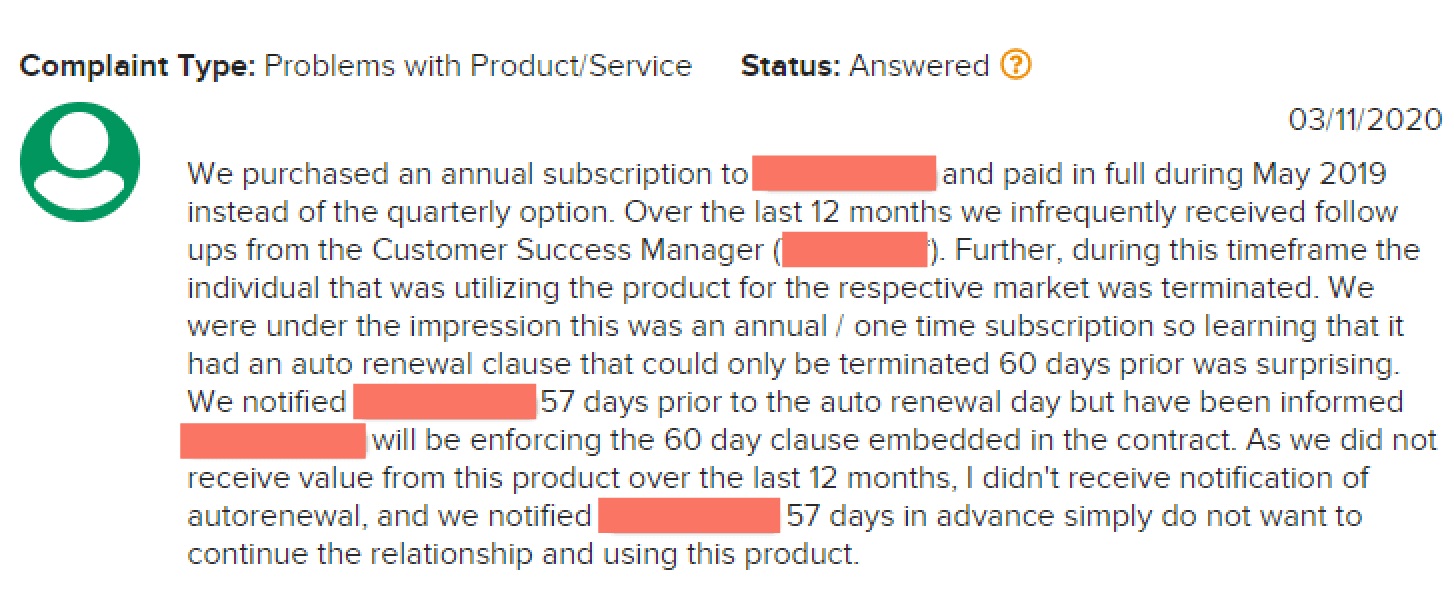

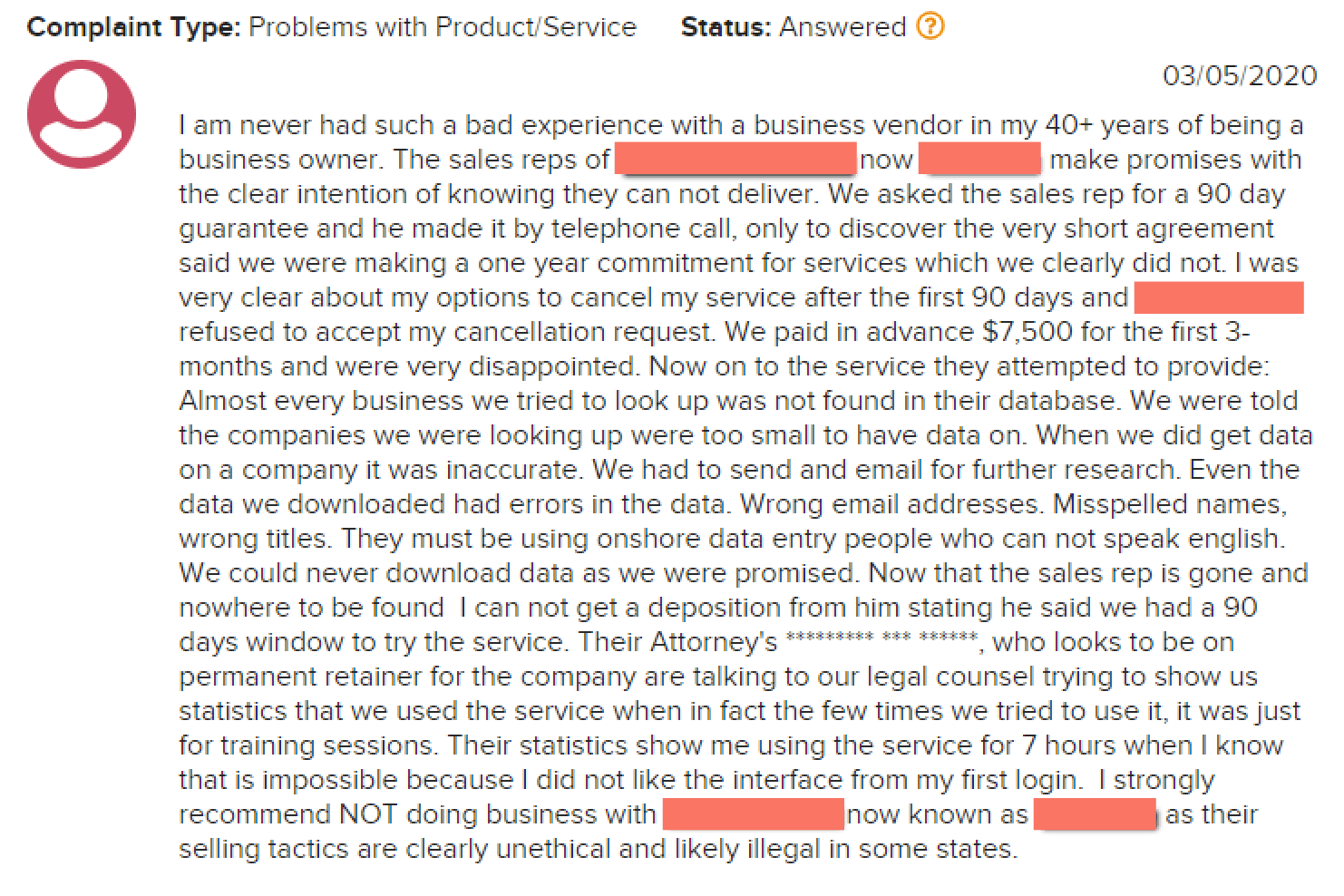

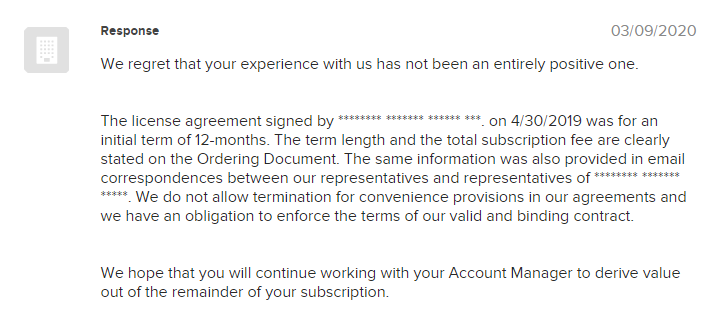

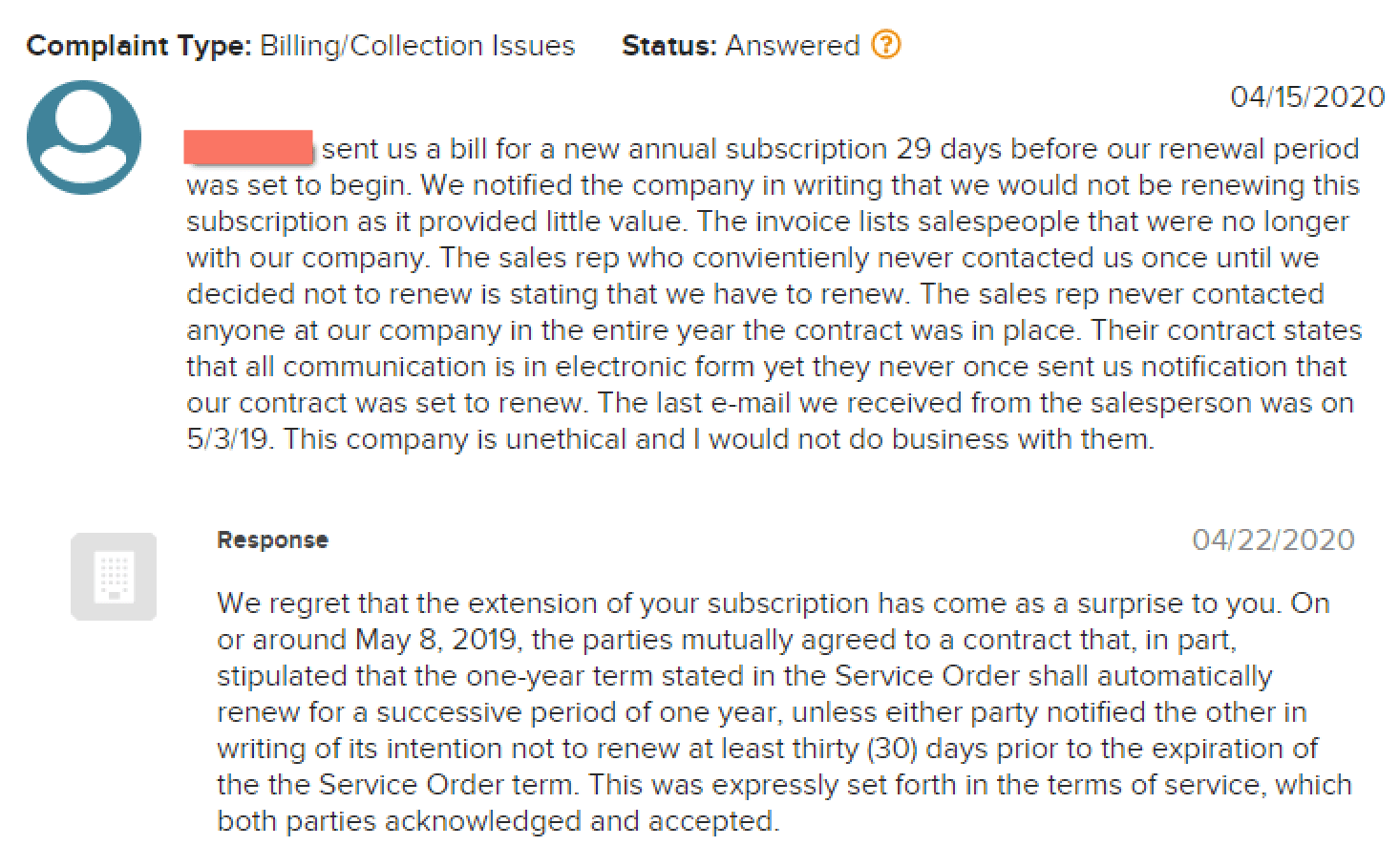

Here is a classic example:

A company believed in the promises made on call by the SDR of a renowned data company and signed the deal. Later they realized that the business relationship was not working for them and decided to discontinue it.

Although the company had already been through a lot of pain, the response made it worse.

2. Pre-Emptively Opt-Out

If your contract does include an auto-renewal clause the easiest and safest course of action is to go ahead and pre-emptively opt-out of the renewal as far ahead of time as possible (ideally right after you have executed the contract). Do this even if you are delighted with your purchase and cannot imagine canceling or switching a vendor.

Remember a lot can happen in a year (and even more with a multi-year contract). You don’t know where you will be as a company, what may have changed with your vendor, and what new offerings may arrive on the market in the intervening time. And even if you do decide to renew you now have the leverage to renegotiate your contract instead of being automatically renewed, often at a locked-in higher price than your initial term.

3. Know Your Point of Contact

If you don’t know who your point of contact or “processor” is, it is difficult to cancel the contract, because that is the one you need to contact, not your sales rep. In some cases, the data partner you think you are signing up with doesn’t provide your processing services. Find out which company/concerned person processes your payments (and also do some research on them). It is this company which is going to handle your money behind the scenes.

4. Submit Your Request in Writing

What is disheartening is that you can call and email, and tell a support rep that you want your account to be canceled, but because these requests for cancellation must be in writing, they may not fulfill your request. Yeah, it’s annoying, because even though you give them permission, the executive on-call cannot really do anything to terminate your account. If your contract states that your cancellation request must be in writing, you can be sure that it is exactly what you will need to do in order to make any progress. And you must also make sure that you submit your request within the correct time frame.

5. Monitor Your Statements.

This stage in the breakup process is usually the most stressful. You have said that you no longer want to continue and still, they continue to charge you recurring fees on your card. Yes, it does happen. Over the next few months monitor your bank or card statements carefully. You should not see any new charges, beyond being charged for the billing cycle during which you were active. Post, follow up, give a letter and repeat until resolved.

Must Read: 5 Reasons Why ZoomInfo Customers Switch to SalesIntel

Don’t Get Trapped In A Vicious Cycle of Auto-Renewals

If you have ever been in an auto-renewal contract where you are not happy with your vendor, you know how terrible it feels. You convinced the board members and did all the required formalities to choose a data partner only to be stuck in a really vicious cycle with no end in sight.

Here is what you may have to go through if you ignore the auto-renewal clause:

If you are a small business owner looking for a reliable B2B data partner, we hope we’ve provided you with enough information to keep you from getting stuck in the auto-renewal trap.

There is a whole world of data companies out there that have proven to be flexible and easy to work with, maintaining transparency in the vendor-client relationship. So, never accept anything less than exactly what you need.