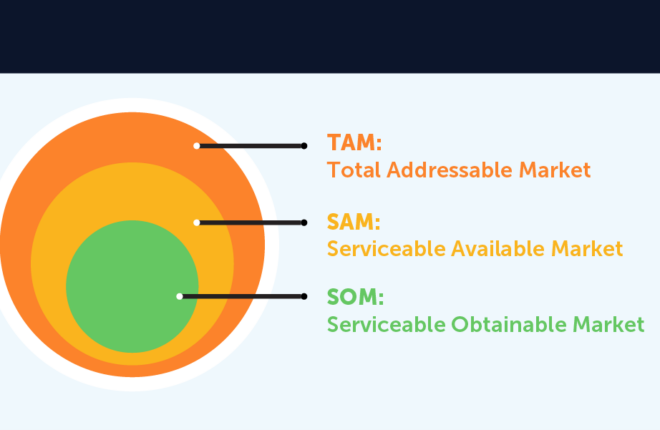

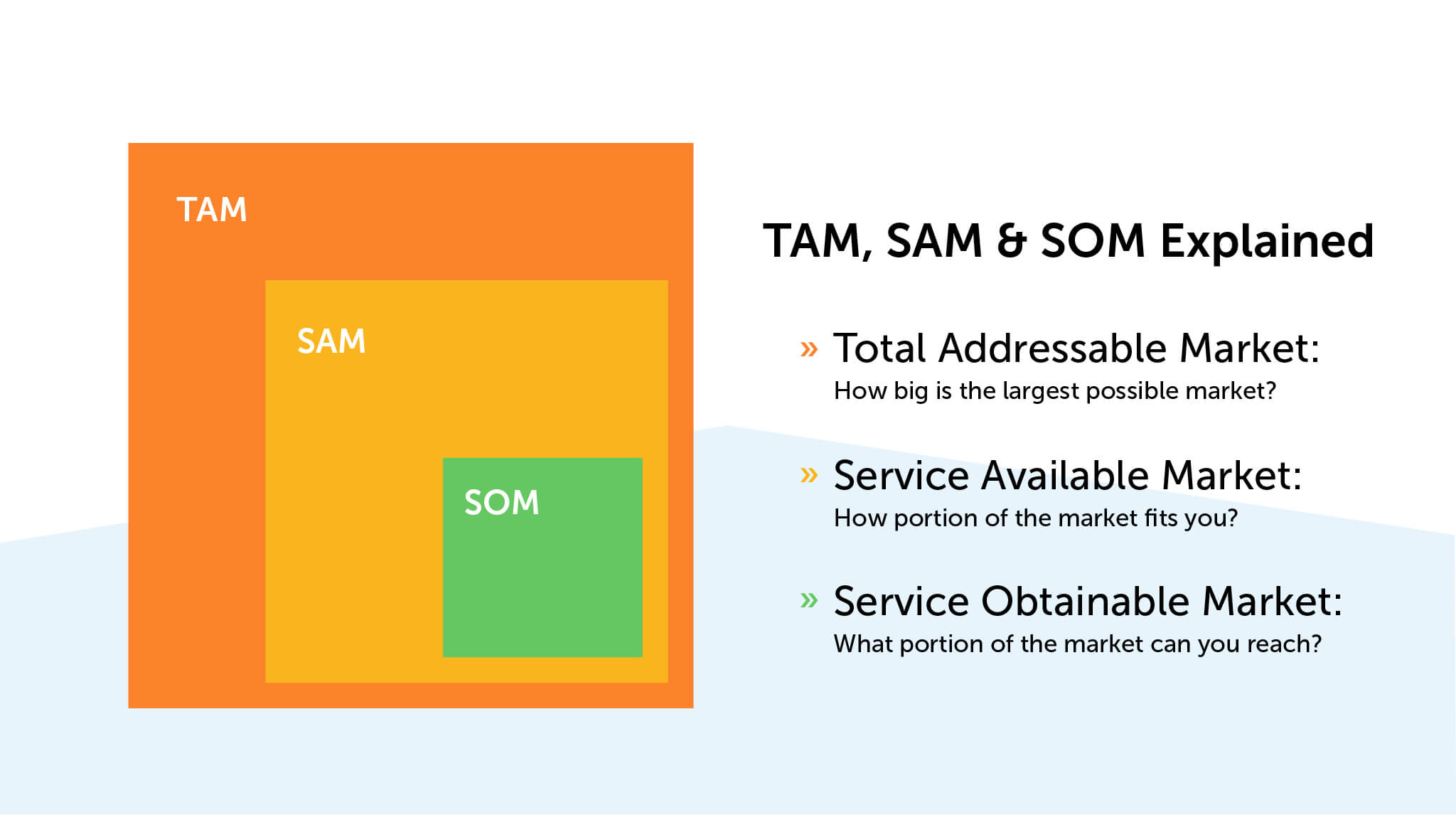

Market analysis reports and records often use the acronyms TAM, SAM, and SOM. TAM, SAM, and SOM refer to a kind of market data research that helps to calculate the growth potential of any particular business. But what do these terms mean, and why is TAM SAM SOM so important?

- TAM – Total Available/Addressable Market

- SAM – Serviceable Available/Addressable Market

- SOM – Serviceable Obtainable Market

Still confused? You’re not alone. All these terms seem similar, and their differences are subtle.

TAM refers to the total market for any product or service. It refers to the total number of people who use a particular type of good/service. But no single brand can acquire the total addressable market.

With its specific product or service, every brand targets a sub-segment of the TAM within a particular geographical zone. This is referred to as the SAM. But there are various market factors beyond the control of any single business entity that prevent it from acquiring the full SAM.

The SOM refers to the part of the SAM that a brand can realistically acquire if it fully uses its resources and planning ability.

What is TAM SAM SOM

TAM SAM SOM is a framework used in marketing to analyze market potential. TAM (Total Addressable Market) refers to the total market demand for a product or service. SAM (Serviceable Addressable Market) represents the portion of TAM that a company can realistically target. Served Available Market (SOM) is the specific segment of SAM that a company successfully reaches. The framework helps businesses evaluate market opportunities and make informed decisions about their target audience and market strategy.

What Does TAM Stand for in Business

TAM, in the context of business, stands for Total Addressable Market. It refers to the total market demand or potential size for a particular product or service. Understanding TAM helps businesses assess the maximum revenue opportunity, evaluate market potential, and make strategic decisions regarding market entry, competition, and growth.

What Exactly Are TAM, SAM, and SOM (with Real Examples)?

Understanding the true size and scope of your market is fundamental to any successful business strategy. It’s not just about dreaming big; it’s about being realistic and strategic with your resources. This is where the concepts of Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) come into play. These three metrics provide a clear roadmap for scaling your ambitions from the broadest possible opportunity down to the most immediate, actionable target.

Let’s break down each term with real-world examples to clarify their meaning and how they apply to your business.

What is the Total Addressable Market (TAM): The Ultimate Horizon?

Think of the Total Addressable Market (TAM) as the absolute maximum revenue opportunity available for a product or service. If you could capture 100% of the market, without any competition or geographical limitations, this is the entire pie you could potentially eat. It represents the total demand for your solution, assuming everyone who could possibly use it, does use it.

Example:

Let’s say you’re selling a digital marketing tool. Your TAM would be the total global spend on all digital marketing solutions (e.g., SEO tools, PPC software, email marketing platforms, social media management, content marketing platforms) by every business in the world, regardless of their size, industry, or location. This is a massive number, often in the billions or trillions, and it’s mostly a theoretical ceiling, indicating the sheer scale of the overall problem your product aims to solve.

The TAM is crucial for investors and stakeholders because it demonstrates the long-term, grand vision for your company’s growth potential. It shows that even with significant market penetration, there’s still enormous room to expand.

What is the Serviceable Available Market (SAM): Your Reachable Segment?

While the TAM is vast and often global, it’s rarely a realistic immediate target. That’s where the Serviceable Available Market (SAM) comes in. The SAM is the portion of the TAM that your business can realistically serve with its current business model, resources, and geographic reach. It acknowledges practical limitations like language barriers, regulatory differences, or your current sales team’s capacity.

Example:

Continuing with our digital marketing tool, you might specialize in serving small to medium-sized businesses (SMBs) because your tool is designed for their specific needs and budget. Furthermore, your operations are currently focused on the English-speaking market due to support and sales team capabilities.

So, your SAM might be defined as:

- All small to medium-sized businesses (e.g., 1-250 employees)

- Located in the USA, Canada, UK, and Australia

- That currently use or could benefit from a digital marketing tool.

This is a much more manageable and realistic segment of the market that your company is equipped to pursue. It helps you refine your marketing and sales strategies to target a specific, accessible audience.

What is the Serviceable Obtainable Market (SOM): Your Immediate, Actionable Target?

Finally, we arrive at the Serviceable Obtainable Market (SOM). This is the most immediate and actionable slice of the pie. The SOM is the portion of the SAM that your business can realistically capture within a specific timeframe (e.g., the next 1-3 years), given your current competitive landscape, sales and marketing resources, and existing market share. It’s about setting practical, achievable goals.

Example:

From your SAM (SMBs in USA, Canada, UK, Australia needing digital marketing tools), you need to calculate what you can actually acquire.

- Considering your sales team’s capacity (how many deals they can realistically close per quarter).

- Your current marketing budget and reach.

- The competitive landscape (how many other similar tools are vying for the same customers).

- Your historical win rates and conversion metrics.

Your SOM might be:

- 10% of the SMBs in the USA (due to concentrated sales efforts and existing brand recognition).

- 5% of the SMBs in Canada and the UK (as you expand into these regions).

- A smaller percentage in Australia as you just begin market entry there.

This calculation helps you set quarterly and annual revenue targets, allocate sales territories, and plan your marketing campaigns with a clear, obtainable goal in mind. It’s the immediate target towards which all your business strategies should be oriented, and it’s the number that often dictates your short-term operational planning.

Why Does This Matter for Your Business Strategy?

Studying the TAM, SAM, and SOM helps business owners:

- Validate Business Viability: Does a large enough opportunity exist to sustain and grow your business?

- Prioritize Resources: Where should you focus your sales and marketing efforts for the best immediate return?

- Set Realistic Goals: Move beyond aspirational figures to concrete, achievable targets.

- Communicate Growth Potential: Clearly articulate your long-term vision (TAM), your reachable market (SAM), and your immediate plan (SOM) to stakeholders and investors.

Understanding these distinctions is essential for all entrepreneurs, especially when preparing investor pitches, as it demonstrates a clear, data-driven understanding of the market and a well-thought-out plan for capturing it. Tools like a professional pitch deck creator can help present these insights effectively and impress potential investors.

What Are the Key Benefits of TAM, SAM, SOM for Investors?

But why is the understanding of clear boundaries of TAM SAM SOM so important? One answer is the TOM SAM SOM analysis helps convince investors about the growth potential of a business.

When the investor has the SAM SOM values, they can determine if there is actual profit potential in the market and if they should invest. The total addressable market also helps the investor identify the exact sector of their target business to understand and learn in-depth about the kind of companies, revenue, and investments made in that sector.

Identifying your TAM SAM SOM reduces the investor’s risk and increases the business’s chances of getting more investors interested.

How to calculate your TAM SAM SOM?

Despite its massive importance in business operations and investor pitches, TAM SAM SOM analysis has not yet gained widespread popularity in the corporate world. Many market researchers may be aware of the analysis but do not clearly understand the process. There are two styles of conducting a TAM SAM SOM analysis:

-

What is the Top-Down Approach to Calculating TAM, SAM, & SOM?

As the name suggests, this analysis begins from the top. Here the market researchers take general statistics of the market sector that the business is interested in to calculate its maximum potential total addressable market.

Then the researchers use demographic data, customer buying trends, and other long-term economic factors to calculate the SAM of the business. The SAM and statistical data available about the average income of other companies in that sector are used to determine the SOM. The specifics of a particular business are not brought into consideration.

This top-down analysis may be great for the initial approach to investors where a new idea is being tested out. It analyzes the growth and profit potential of the business idea. But in most cases, investors prefer a more detailed TAM SAM SOM analysis before making their final investment decision.

-

What is the Bottom-Up Approach to Calculating TAM, SAM, & SOM?

This approach of total addressable market SAM SOM gives a more company-specific understanding of the market potential. Investors who want to de-risk their investment in a company will always want a bottom-up TAM SAM SOM before making any substantial investment.

In the bottom-up TAM SAM SOM style, the researcher collects data about the company’s current sales, sales leads, and total product volume. This information is used for the SOM analysis. But this data is not enough. The tangible figures from company statistics should be aided with data from market research about the TAM and the SAM sizes.

When the company’s potential and general market figures are brought together, it gives investors the complete picture of their potential gains and losses. So, the best TAM SAM SOM calculation approach uses a mix of top-down and bottom-up styles, the TAM and SAM from top-down and the SOM from bottom-up.

How Do TAM, SAM, and SOM Help Business Owners Make Smarter Decisions?

TAM SAM SOM is not just a good idea for approaching new investors. Business owners and managers can also gain a lot of insight into their business with the help of a TAM SAM SOM analysis.

- Firstly, a TAM SAM SOM analysis can give an entrepreneur an idea of whether their business is commercially viable. A business idea with a limited SOM may not always be economically feasible.

- A TAM SAM SOM analysis will also help a company understand the potential market they need to target. This figure can then be used to calculate the basic amount of investment needed to start the business.

- TAM SAM SOM analysis can also be a good marker to evaluate business performance. A company should try to assess if it can reach its SOM goals regularly. If the company’s expected SOM is too far from its actual SOM, it suggests some operational roadblocks, and the system needs a complete overhaul.

- In most cases, the discrepancy between ideal and real SOM is inadequate or improper CRM and lead generation. Many companies do not address and provide outreach for a sizable section of their SOM. They need to increase their database with better lead contact generation so more of their SOM become actual customers.

With native integration with leading CRMs, including Salesforce, Hubspot, Marketo, and more, SalesIntel helps you quickly build your prospect lists and export contacts directly to your CRM or email marketing system. Get accurate data when you need it, where you need it.

- TAM SAM SOM analysis can help determine future strategies. If a company finds that its TAM is high, but its SAM/SOM figures are inadequate, it can be an indicator to realign its primary target sector. Companies may modify their product/service to attract a larger category of customers and have more potential for growth.

- TAM SAM SOM analysis of a business also helps owners develop a viable market value for their business that they can use when approaching investors.

Product launches, company creation, marketing, and branding require proper market research before making final decisions.

TAM SAM SOM analysis is a comprehensive form of market research that produces a lot of valuable data in one go. It validates the basic business proposition, helps the business assess and modify its products, and brings in investors.

Data is the key to performing accurate TAM SAM SOM analysis. Decision-makers rely on insights such as firmographics, technographics, buyer intent data, and more to identify potential target accounts and buyer segments best matched to their products and services.

SalesIntel’s B2B Buyer Intent Data, technographics, and firmographics data and insights allow you to calculate SAM SOM to build a solid go-to-market strategy. We have over 1900 researchers working around the clock to deliver the highest quality of B2B company data and contacts.

Using accurate data to do your TAM SAM SOM analysis also helps build predictable revenue forecasts and sales projections for different stakeholders in the company.

Should you invest in TAM SAM SOM analysis?

There are many ways a TAM SAM SOM analysis is useful. Of course, this analysis requires large data mining and in-depth review. In the long run, it provides proof of concept for any capital inflow from investors and can align your team for revenue generation.

The TAM SAM SOM analysis also reduces the potential for a business owner to take undue risks in impractical business sectors.

How Can I Calculate My TAM, SAM, and SOM (Using Data & Tools)?

How Do I Start Calculating My Total Addressable Market (TAM)?

Let’s say you’re selling a digital marketing tool. You could technically have any-size customer anywhere in the world.

TAM = (annual revenue per customer/contract) x (number of total possible customers/contracts).

Your TAM would be your ACV ( annual contract value) times the number of potential customers. If the only limit on our search is that there is marketing or sales leadership at the company, SalesIntel gives us over 1 million companies and over 1 million possible contacts. That’s an exciting amount of people you could go after.

How Do I Narrow Down My Market to the Serviceable Available Market (SAM)?

The SAM formula is account-product fit based on technographics, firmographics, scale, and persona-product fit based on titles, teams execs, budget holders, and all-time ACV (annual contract value). So, how many accounts and personas fit your theoretical marketing product? Let’s say you want the US Market, 10 – 1,000 employees, leadership in sales, marketing, or RevOps, and still any vertical, but a CRM and cadence tool used. If we pop those criteria into

SalesIntel, we get 72K companies and 257K contacts. We’re down to 1/15 of the TAM size and starting to look at a more reasonable number of companies to be chasing. At least you won’t be trying to fit a million contacts into your CRM.

How Can I Set Realistic Expectations for My Serviceable Obtainable Market (SOM)?

If you’re using a data provider like SalesIntel, we can run your SOM calculation and provide your targeted list. Besides having a model for revenue forecasting, you’ll know which deals you’re most likely to win and can make them a priority. If you’re using a B2B database, you can pull a contact list exactly matching your ICP to kick o your sales and marketing efforts.

SalesIntel offers the best data quality with 90-day re-verification to ensure the best, most reliable TAM SAM SOM analysis results.

Ready for a demo tailored to your ICP?