It takes a lot for a FinTech marketer to reach decision-makers and score deals. There is good news though. Traditional financial institutions are becoming more inclined to adopt technology, which has opened up opportunities for FinTech companies.

However, there has been a rise in competition over the last 5 years, making it difficult for Fintech marketers to get their foot in the door with their potential customers.

While the financial technology market is generating higher profit margins, thousands of vendors are seeking the attention of hundreds of financial institutions.

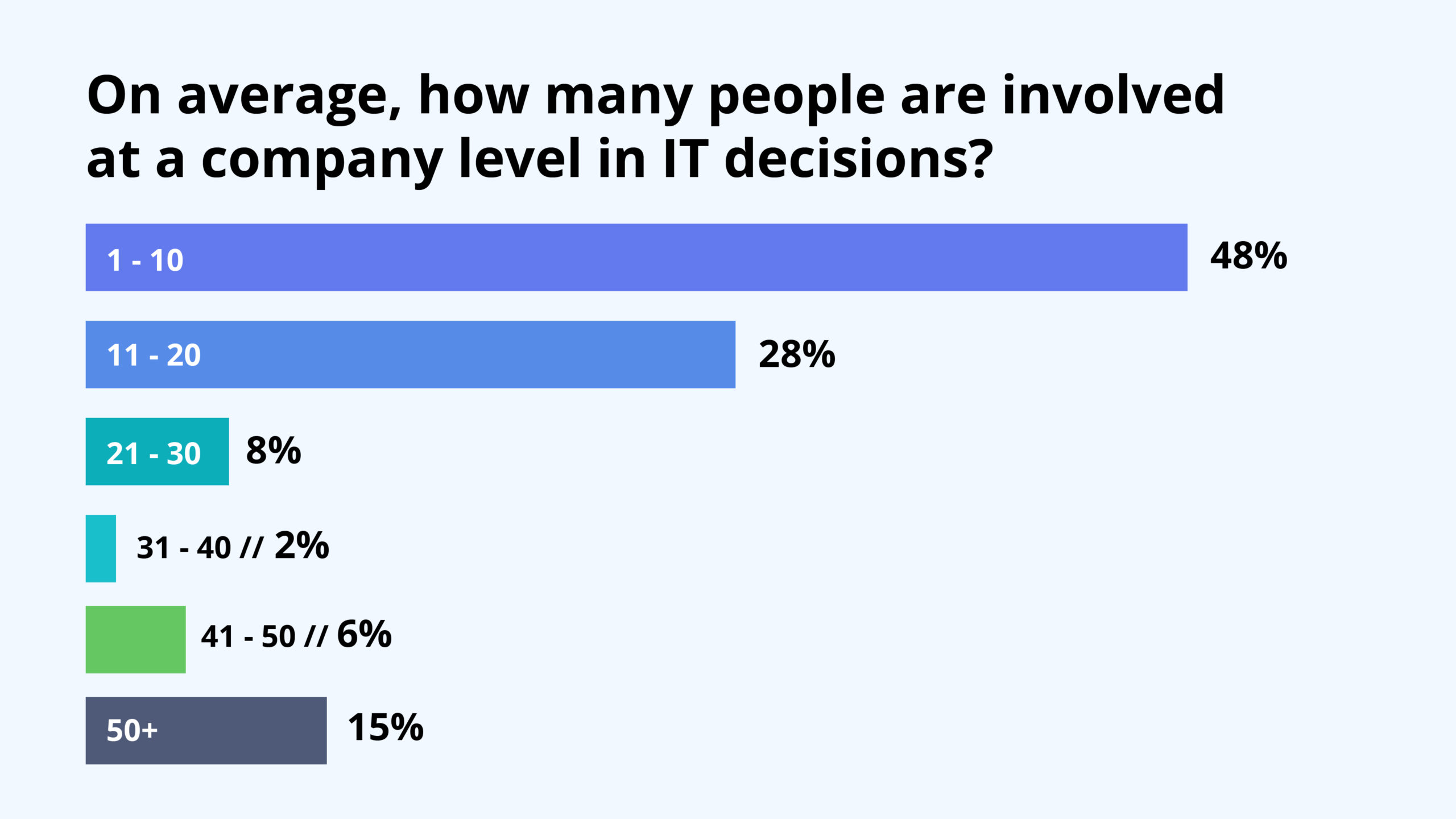

At the same time, for financial institutions, as their technology investments grow in size, the number of decision-makers involved in the buying cycle has dramatically increased.

Since the decision-makers have increased, FinTech companies are investing in marketing to support sales efforts and taking a systematic approach to selling to financial institutions.

The Four Pillars Of Fintech Marketing

Marketers are trying to identify the right balance of inbound and outbound marketing techniques. While both are effective for driving lead generation, finding the right balance to generate steady lead flow is the key.

Incorporate the following four pillars in your FinTech marketing strategy.

- Search Engine Optimization (SEO)

- Content Marketing

- Marketing Automation

- Email Marketing

1. SEO

This is critical when consumers are researching FinTech products. If you’re not ranking on the search engine results when they search, you likely won’t get seen. Search engine optimization helps your potential leads find your brand on the search engine. However, it is important to perform thorough keyword and competitor research before optimizing the website. You can either hire an in-house SEO team or outsource SEO to the experts.

2. Content Marketing

Content marketing is about delivering the right content, to the right audience, at the right time, and using the right channel. Create content that will educate financial institutions for each stage of the customer buying journey. You can address the pain areas, provide the solution, and use case studies to convince.

3. Email Marketing

Email marketing has always been a staple for B2B marketers. What has changed is the way 93% of B2B marketers use email marketing to distribute content.

Prospects who consume or show interest in your content are most likely to convert as qualified leads, but not immediately. Here’s when email marketing helps you to take a customer-centric content approach. Similar to your content approach, your email marketing should provide real value and not just sales material. Targeted FinTech marketing emails can nurture leads further and drive them to the next stage.

SalesIntel provides you access to millions of human-verified banking and finance industry database contacts to boost your email marketing and reach out directly to decision-makers from the get-go.

4. Marketing Automation

Managing inbound activities on your own is difficult. As a result, most FinTech marketers are using Marketing Automation to drive prospects through the buyer’s journey. Automation saves time in so many aspects of your marketing and sales, including workflows, email marketing, reporting, lead qualification, and much more, freeing up your time to focus on growing your FinTech business.

5-Step Approach While Selling to Financial Institutions

Once you have succeeded in marketing your brand to decision-makers, it is important for you to shift the sales process into high gear.

Let’s quickly go through the 5-step approach of selling to financial institutions and how SalesIntel can help you at each step to capitalize on the opportunities.

1. Research Prospects

Before you start selling your product, it is important to know who you are selling to. Answers to questions like the following help you to better understand the prospect:

- “What are the existing tools your prospects are using?”

- “What are your employee strengths?”

- “Who’s the decision-maker?”

- “What is the revenue?”

SalesIntel provides you the firmographic of financial institutions to boost your research and get the answers to all these questions. So rather than blindly calling a prospect, perform your due diligence using SalesIntel to learn more about the prospect.

2. Call… And Call at the Right Time

Although emails are the best way to approach decision-makers, sometimes your subject line or your email message may fail to convince the prospect. An email followed by a call will create more chances of getting a response. Thus, calling is important. However, make sure you call the prospects at the right time. Calling in the first half of the day might make it difficult to reach the decision-maker.

With the SalesIntel portal, you get access to the most direct-dials in the industry of the decision-makers to ensure you reach the right person at the right time, bypassing the gatekeeper.

3. Ask for Permission

Sales doesn’t happen overnight. You need to stay patient. If you are not able to get to the decision-maker, don’t be afraid to ask for permission to talk to the decision-makers. Many sales reps often disqualify a prospect if they fail to reach the decision-maker after the first two attempts. Just because a receptionist answers the phone doesn’t necessarily mean that it’s a lost sale. If you handle the situation properly, you can create an opportunity to reach the right person.

Here at SalesIntel, we make sure all the direct-dials from our portal are human-verified and goes through the re-verification process every 90-days so you need not have to convince the receptionist anymore!

Need data on a specific industry or contact that’s not already in our database? Submit your request and we’ll find the data for you.

4. Explain Benefits

Never try to convince prospects and leads to buy your product just for the sake of selling. FinTech marketers need to explain the benefits of your product or service, not just the features. This should reflect in your marketing as well as selling approach. Try to understand existing technology or tools they are currently using, and try to convey the benefits of your product over their existing product. If they are using a tool that can be integrated with your product, try to convey the combined benefits. If the prospect believes your product or service is beneficial to their company, it will certainly help you in closing the deal faster.

SalesIntel helps you with the technographic data of the financial institutions and banks to supplement your sales pitch.

5. Balance Selling and Research

Selling to financial institutions takes solid research and sales acumen. While research is an important part, you need not have to exhaust all of your time and resources on it. You need to balance the time spent on research and selling.

SalesIntel is your one-stop selling and research solution, offering a banking and financial database with enough individual and company information to crack the hard nuts.

Ready to get started? Schedule a demo to witness our data inventory or download RevDriver FREE Chrome Extension to check our data accuracy.